Pulse Market Insight #239 SEP 22 2023 | Producers | Pulse Market Insights

Concerns About India Front and Centre

(Please note that this was written on Sept. 22, 2023 and the situation remains fluid.)

One of the “fun” parts about following crop markets is that, on top of the usual uncertainties like weather, things can come out of left field, if you will. There’s been all kinds of information about Canadian crops in the last few weeks, including two StatsCan production estimates and an ending stocks report. Besides that, there’s production, trade and price data from various countries that influence the outlook.

One thing we didn’t have on our pulse market “bingo card” for 2023 was a full-blown diplomatic ruckus with one of our largest trading partners. The relationship between Canada and India could already be described as “strained but manageable” but Canada’s recent claims of assassination and interference have kicked the situation up to crisis level. In this type of environment, anything could happen, which is raising all kinds of concern about India’s stance on imports of Canadian pulses. In this report, we’re not going to debate the political issue, but discuss what’s at stake.

India hasn’t been a meaningful importer of peas from anywhere since late 2019, when it added restrictions on pea import volumes to the existing 50% import tariff. As a result, we haven’t really thought about India as a pea buyer for a few years and this diplomatic dispute couldn’t make things worse. Or could it? Lately, some intriguing possibilities were starting to show up.

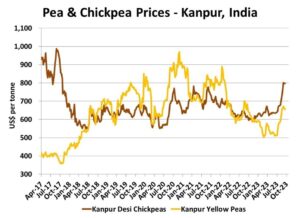

Prices of desi chickpeas and yellow peas in India have been rallying sharply since the beginning of July, with chickpeas now at the highest point since late 2017. Yellow pea prices are still below levels of the last few years but are rising. With an Indian general election coming up next spring, there have been suggestions the government could reduce barriers for pulse imports to keep food prices in check and put voters in a better mood.

This outcome is far from certain but was raising some interesting possibilities. Of course, Canada has fewer peas to sell in 2023/24 but, as anyone who’s been at an auction sale knows, it never hurts to have more buyers bidding. If the Indian government was planning to open the doors to Canadian peas but now changes its mind, that would certainly snuff out some optimism for Canadian pea prices, especially yellows.

When it comes to lentils, an escalation in the situation would have more serious impacts. India is a major buyer of Canadian lentils, taking 15% of Canadian green lentil exports and 37% of red lentil exports in 2022/23. Losing that type of market would be negative for prices, more so for reds than greens. That said, the low Canadian supplies in 2023/24 would help limit the price damage.

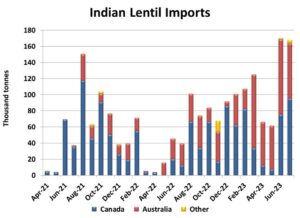

From India’s perspective, it relies heavily on Canadian supplies of both red and green lentils. Australia has become a larger source of red lentils lately, but not enough to fully meet India’s needs. That’s especially the case since the Australian lentil crop will also be down considerably in 2023/24, 27% less than the year before.

We’re also seeing that Indian lentil imports have been trending higher for months and jumped sharply in June and July to the highest level in several years. This exceptionally strong demand for lentils suggests that cutting off access to Canadian supplies would have large repercussions for prices within India. And as mentioned above, with an election in a few months, triggering higher food prices wouldn’t be a popular move.

Keep in mind, there’s nothing to say India will decide to restrict pulse imports from Canada. In our opinion, we think the odds of this outcome are fairly low, but certainly not zero. This type of situation is unpredictable, but just crossing fingers and hoping it doesn’t happen may not be a very prudent marketing strategy.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.