Pulse Market Insight #240 OCT 13 2023 | Producers | Pulse Market Insights

The Latest Scoop on Peas

Even though it’s early in the 2023/24 marketing year, there’s already a lot going on for peas; some good and not so good. It was another challenging production year, with drought showing up again for some farmers, leading to the obvious comparison with 2021/22 when yields were cut back severely. Even though the 2023 Canadian pea crop was about the same size as the 2021 drought year, there are some big differences in the 2023/24 market that will affect the outlook.

The last crop estimate from StatsCan pegged 2023 pea production at 2.27 mln tonnes, down 34% from last year. That’s based on a sizable cut in acreage and a yield of 28.1 bu/acre, but there’s a good chance the crop isn’t quite that small. Yields from both Alberta Ag and Sask Ag crop reports were 34.6 and 29.4 bu/acre respectively, well above StatsCan’s provincial yields. If we plug in the crop report yields, the 2023 crop would be 2.61 mln tonnes, still not huge but supplies wouldn’t be quite as tight. One bit of good news is that the pea harvest was completed in good time and quality was above average.

One other important development on the production side is that according to StatsCan, seeded area of green and specialty peas dropped 25-30% while yellow acreage was down by only 6%. The more severe acreage cuts to smaller pea classes meant the lower 2023 yields hit the output of green and specialty peas much harder.

While Canada’s total pea crop in 2023 was in the same ballpark as 2021, the demand part of the outlook is quite different this year. China is still the dominant driver of demand for Canadian peas and while its total imports may not change much this year, the sources are shifting. In the last few years, Canada has frequently supplied over 90% of China’s requirements, but Russia has now entered the picture and in the last two months, has accounted for more than half of Chinese imports.

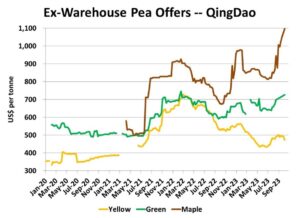

Most of these Russian imports are yellow peas for the food/fractionation and feed markets, which is why those prices are under pressure. Prices for yellow peas offered out of Chinese warehouses to local buyers had moved higher in late summer but have now levelled off or even turn a bit lower. For green and maple peas, China is still heavily dependent on Canada. Concerns about Canadian supplies are reflected in prices for those classes, including an extreme spike in maple pea prices. Prices for greens are now at the same level as 2021/22 while maples are at an all-time high.

On a more positive note, it’s still possible India could reduce its restrictions on pea imports that have been in place since late 2019. Prices for most Indian pulses, including peas, have been rising the last 2-3 months, due to concerns about the kharif crop now being harvested and the next rabi crop that will be planted soon. Rising food costs will be a large issue in India’s elections next spring and allowing more pulse imports could help boost supplies, lower prices and ease those concerns. Keep in mind, dropping its import restrictions on peas is far from a sure thing. But if India would make this move, it would be a large shift in global pea demand.

Based on what we know so far, Canadian bids for yellow peas won’t respond nearly as exuberantly in 2023/24 as they did in 2021/22. But it’s already obvious the situation is very different for each of the classes of peas. Prices for green and minor classes are benefiting from much stronger demand in the face of limited supplies and that should continue through the rest of 2023/24.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.