Pulse Market Insight #242 NOV 10 2023 | Producers | Pulse Market Insights

Market Signals from Early Export Numbers

The first quarter of the 2023/24 marketing year is now in the rearview mirror, but gives us some signals of how the rest of the year could play out. Of course, nothing is written in stone and markets are continually evolving. There’s always the possibility of surprises, either positive or negative, in both the supply and demand sides of the outlook.

At this stage of the year, when the Canadian crop is in the bin, attention shifts to demand factors, especially exports. We use two sources of export data, each with some limitations. Monthly export numbers from StatsCan provide the most complete information, but they aren’t as current. StatsCan issues export data 5-6 weeks after the fact, with September exports showing up in the first week of November. The Canadian Grain Commission reports exports weekly, but these don’t include exports by container, which are sizable for pulses and other special crops.

Before getting into details, it’s worth noting that exports in the first month or two of the marketing year include a mix of old-crop and new-crop inventories. Export potential early in the year can be limited (or boosted) by how much of last year’s inventory is still available, and that can vary by crop. More important, availability of new-crop pulses was seriously reduced by the 2023 drought. This means that for most crops, 2023/24 exports won’t be able to achieve normal levels, regardless of demand.

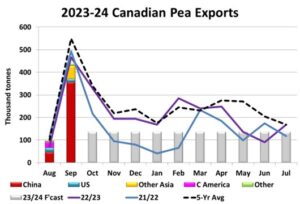

The StatsCan data shows that pea exports in August and September followed the normal seasonal pattern, but amounts didn’t quite keep up to the average. China is still the dominant destination, but some demand is coming from other countries, including Bangladesh and Cuba. If there is a bright side to weaker yellow pea prices, it’s that they can spur more demand from some price-sensitive destinations. Exports to the US so far have been quieter than usual, mainly because its own pea crop in 2023 was larger. The CGC weekly data suggests October exports will also be below average.

The chart shows that, based on StatsCan’s 2023 production estimate, exports will need to slow down sharply the rest of the year. Volumes will be well below average, even if StatsCan raises its 2023 pea crop estimate. We’re not really concerned about below-average exports for 2023/24 because they aren’t caused by lack of demand but rather by limited supplies. Of course, price behaviour so far this year clearly shows that the supply shortfall is much more serious for green peas than yellows.

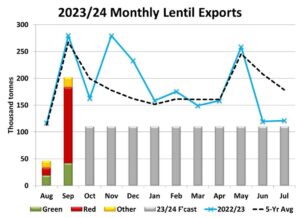

It’s a similar picture for lentil exports, which started slowly but bounced back in September. And just like peas, amounts have been well below average. So far this year, there hasn’t been a change in where these lentils are headed, with India, Turkey and the UAE as the largest destinations. According to the CGC weekly data, lentil exports should be solid in October, and could even exceed the average.

Canadian lentil exports will be seriously constrained for the rest of 2023/24 as supplies aren’t nearly large enough to support an average export program. The demand side of the lentil outlook is clouded by the availability of Australian red lentils but it’s also clear that Indian buying has been strong and will likely continue that way.

The common denominator for all Canadian pulses this year, including chickpeas and dry beans, is that export programs will be on the quiet side, but only because supplies are smaller than usual. This is positive for the price outlook, although the amount of upside potential varies by crop and class.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.