Pulse Market Insight #244 JAN 5 2024 | Producers | Pulse Market Insights

Planting Ideas for 2024

At the turn of the calendar, it’s natural to think about what the coming year will bring. Of course, farmers don’t wait for January to make their seeding decisions. Over the last few months, they’ve already been making plans about which crops to plant in 2024 and there may not be much left to decide. Even so, there might still be a few “swing” acres.

Many factors go into choosing which crops to plant; prices are only one part of the equation. Crop rotations, disease and weed management, market diversification and other factors are critical and tend to limit how much change is possible from one year to another.

Every year around this time, we look at early new-crop bids and some basic crop input costs to get an idea of which crops pencil out better than others from a gross margin perspective. It’s more of a back-of-the-envelope look than a rigorous analysis. We’ve also had some feedback from farmers and others about which crops might be catching farmers’ eyes and which ones aren’t.

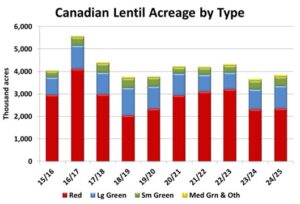

The results of our gross margin comparisons aren’t all that surprising. Overall, pulses perform well within the rankings as they normally do, but some look better than others. As expected, green peas show up better in the rankings than yellows. Likewise, green lentils perform better than reds. Kabuli chickpeas also look quite strong compared to other crops in the brown soil zone.

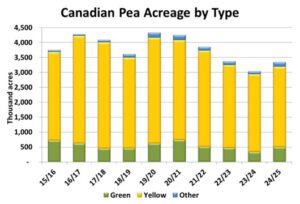

So what does that mean for seeded area in 2024? Generally, we’re looking at pulses to recover from the small acreage base of 2023, but the changes aren’t huge. And they aren’t uniform. For example, our guesstimate for 2024 pea plantings is 3.35 mln acres, up 10% from last year’s low. Most of that increase is expected to show up in green peas and minor classes like maples. A 10% increase sounds like a lot but this acreage would still be toward the low end of recent history. The one big unknown in the pea market is whether India will extend its zero-tariff decision for yellow peas, which would change the outlook considerably.

Likewise for lentils, we’re guesstimating total acreage will recover to 3.85 mln acres in 2024, a gain of 5% over last year but still a relatively small acreage base. Of this roughly 200,000 acre increase, green lentils would attract most of the added acreage, as those new-crop bids have been much more attractive.

We are also looking at acreage increases of roughly 10-12% for both chickpeas and dry beans in 2024. For both crops, these would be meaningful acreage increases but seeded area still wouldn’t be historically high and shouldn’t result in heavy supplies.

As always, the weather and its impact on yields will have the largest say in 2024/25 crop supplies and the market outlook. Keep in mind, the crop types that look most attractive right now will also be noticed by other farmers in Canada and elsewhere. We don’t usually give specific marketing recommendations, but would suggest aggressive forward-pricing for crops that are more eye-catching.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.