Pulse Market Insight #245 JAN 19 2024 | Producers | Pulse Market Insights

Mostly Good News in Canadian Pulse Exports

The 2023/24 marketing year is nearly half over. Export progress early in the year provides clues not only about market direction in the second half of the year but also about supplies that will be carried over into 2024/25. For pulse exports, there have been some stumbles and some surprises but for the most part, it’s positive news.

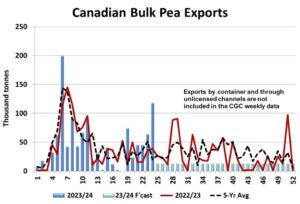

Considering the small pea crop in 2023, Canadian exports started 2023/24 at a good clip, with volumes keeping pace with the last couple of years. Exports dropped off to only 132,000 tonnes in November though, a bit of a warning signal. The good news is that in early December, the Indian government decided to drop its import tariff on peas to 0% until March 31 (unless it gets extended).

In the weekly CGC export data (which doesn’t include container shipping), we see the lull in exports during November (weeks 14-18). That’s followed by several weeks of above-average exports including 118,000 tonnes in shipping week 24, the result of the resumed trade with India. Movement of peas from country elevators to the west coast is still strong, which means a few more weeks of solid exports.

Even more important than the peas exported so far in 2023/24 is the potential for the rest of the marketing year. Because of the small 2023 crop, low supplies will mean export potential will be limited for the rest of the year, which should make buyers more willing to pay up for peas later in 2023/24.

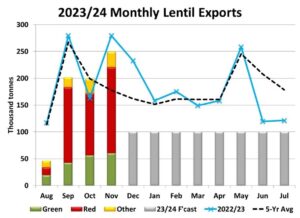

After a slow start in August, lentil exports picked up in the next three months, with StatsCan showing 250,000 tonnes in November. The CGC data for December and the first half of January shows a much quieter pace, so StatsCan exports will drop in those two months. But just like peas, Canadian lentil supplies are low in 2023/24 and there simply won’t be enough to export at an average pace for the rest of the year. This means that any new export business would likely result in firmer bids as inventories are drawn down.

The situation for Canadian chickpeas is quite similar. Through the first four months of 2023/24, StatsCan is reporting exports of 71,000 tonnes, one of the strongest starts in recent memory. The issue (like other pulses) is that Canadian chickpea supplies are the lowest in several years and just like lentils, exports will need to slow sharply for the rest of the year.

So far in 2023/24, dry bean exports have been 127,000 tonnes, a record pace. That’s largely due to very strong demand from Mexico, especially for pinto and black beans. Canadian supplies are solid but not unlimited and will also be drawn down in the second half of 2023/24, with low ending stocks.

The common denominator for all pulses is that export demand has been quite strong and supplies are going to get scarcer in the latter half of 2023/24. An unforeseen event is always possible, but we think these dynamics are setting the stage for firm prices for all pulses in the coming months. By the end of 2023/24, inventories will be low, which also means less supply cushion for 2024/25.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.