Pulse Market Insight #246 FEB 2 2024 | Consumers and Producers | Pulse Market Insights

Half-Time Analysis

The end of January is officially the halfway point of the Aug-Jul marketing year, and pulse markets have seen some interesting developments. The short crops of 2023 resulted in record prices for green peas and green lentils. The yellow pea market got a spark from India’s decision to allow imports, even if only temporarily. Exports of kabuli chickpeas and dry beans have been exceptionally strong, even if they haven’t yet given prices a lift. Red lentils are the only market that could be described as boring.

Just like a football game, half-time is a good chance to take stock of performance and make changes if necessary. Circumstances frequently change and there’s often a shift in momentum during the second half.

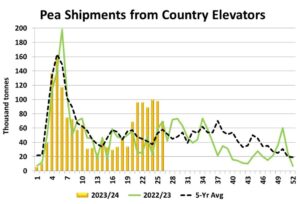

The yellow pea market was dull for the first few months of 2023/24, as exports to China were running at a typical pace, despite the influx of large volumes of Russian peas into China. Prices were mostly flat until early December, when India decided to drop its import restrictions and purchase Canadian yellow peas for the first time in years. That created an unusual midseason bulge in movement and a bump in yellow pea bids.

The yellow pea outlook for the second half of 2023/24 (and early 2024/25) will largely hinge on whether India extends its zero-tariff decision beyond March 31. Without question, Canadian supplies will be tight in the second half of 2023/24 but if India and China are both buying at the same time, prices would see more upside. We think the odds of an extension are roughly 50/50 but India may not announce a decision until late March.

For green peas, there’s been no shortage of excitement, with very low supplies and very high prices. That won’t change in the short-term as there are no fresh supplies of green peas hitting the global market until the next North American harvest. That said, there’s plenty of talk about boosting 2024 acreage, raising the potential (with decent weather) of pulling the market lower eventually. So far, old-crop and new-crop bids are very positive but could start tipping lower as summer approaches.

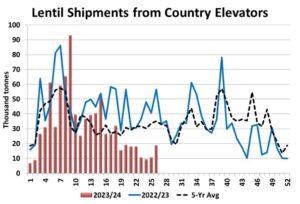

The green lentil market is much like green peas. Supplies are low and prices are record high, with new-crop bids also exceptionally strong. Canada and the US are the two dominant exporters of green lentils and fresh supplies won’t show up until the fall. Old-crop bids will likely remain “frothy” until the 2024 crop is looking more certain. With a big increase in Canadian and US acres expected, new-crop bids could start to weaken earlier.

Red lentil prices haven’t met farmers’ expectations so far in 2023/24. Earlier, bids turned higher due to strong demand from India but that seems to have faded. So far, exports to other regular customers like Turkey have been disappointing and Australia continues to ship large volumes of red lentils. The key risk for the red lentil outlook is the potential for a large Indian harvest in February and March, which could reduce its demand for imports.

Canadian exports of kabuli chickpeas have been very strong early in 2023/24. Based on StatsCan’s 2023 crop estimate, very few chickpeas will be available for export in the second half. That said, those production numbers are often underreported and get revised higher. So far, the tightening supply situation hasn’t given a boost to bids, but they’re not exactly low either. The tight supplies could mean more strength is possible in the second half of the year.

The main development in the dry bean market has been the small Mexican crop, triggering very heavy imports from both Canada and the US this year. That situation isn’t expected to change in the short-term and this strong trade will draw down supplies in Canada and the US, keeping prices well supported through the rest of 2023/24.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.