Pulse Market Insight #248 MAR 15 2024 | Producers | Pulse Market Insights

StatsCan Acreage Possibilities

We recently got a look at StatsCan’s first estimates of 2024 seeded area, which showed farmers are looking favourably at planting pulses this spring. Keep in mind, these projections were the result of a farmer survey conducted in mid-December to mid-January and a few things have changed since then. Prices for most (but not all) pulses have been steady to higher while several other crops have dropped in value, making pulses a stronger competitor for acres. Concerns about dry conditions are also favouring pulse crops. As a result, actual seeded area for pulses this spring will likely be larger than reported by StatsCan.

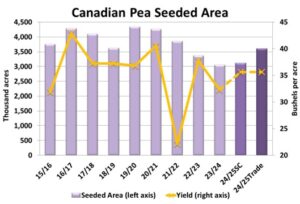

In its estimates, StatsCan is projecting 2024 pea seeded area at 3.1 mln acres, up 2% from last year but still well below the 5-year average of 3.8 mln acres. A Reuters poll of traders and analysts showed a range of estimates from 3.1 all the way up to 4.9 mln acres, with an average of 3.6 mln acres. Because of the improved outlook for peas since the StatsCan survey, we would lean more toward the trade guess. While StatsCan doesn’t break down its forecast by type, we would also expect seeded area of green peas would expand more than yellows.

At this early stage, there’s no guarantee of how the crop will perform, but if yields recover to average levels, 2024 production using the StatsCan acreage would hit nearly 3.0 mln tonnes, 14% more than 2023. If we apply the trade guess for acreage, production would hit 3.4 mln tonnes, 31% more than last year and supplies could start to feel heavier. And if green pea acreage expands more, there’s greater risk of oversupply for that portion of the market.

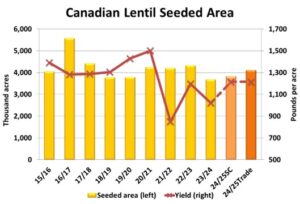

StatsCan is also projecting an increase in lentil seeded area for 2024 at 3.8 mln acres, 4% more than last year but lower than the 5-year average of 4.0 mln acres. Just like peas, the average trade guess of 4.1 mln acres is higher than StatsCan. The much stronger prices for green lentils will encourage more of those acres, but reds could also see an increase.

If yields manage to recover to average levels, the 2024 lentil crop (with StatsCan’s acreage) would come in at 2.1 mln tonnes, 24% more than 2023. And with the trade guess of 4.1 mln acres, production would reach 2.2 mln tonnes, 33% more than last year. If acreage of green lentils increases more than reds, the boost in production would be weighted toward greens and could weigh more heavily on that side of the market.

According to StatsCan, acreage of other pulses is also expected to increase. Seeded area of chickpeas was forecast at 400,000 acres, 27% more than last year, which raises the potential for a much larger crop in 2024 (depending on yields of course). Dry bean plantings are projected to rise to 359,000 acres, 13% more than last year but an average yield wouldn’t boost production all that much.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.