Pulse Market Insight #249 APR 1 2024 | Producers | Pulse Market Insights

USDA Acreage Impacts

The USDA just released its 2024 Prospective Plantings report, an early indication of farmers’ seeding intentions. While most analysts are focused on the corn and soybean numbers, we look more closely at minor crops, including pulses. These estimates certainly aren’t the final word in US acreage; better data will show up in late June and then in August forward. Even so, the USDA’s numbers are a good place to start. And just like in Canada, farmers are looking favourably on pulse crops.

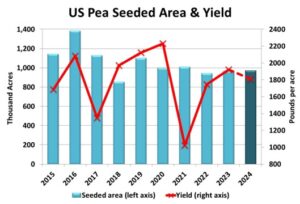

The USDA reported 2024 seeded area of peas at 974,000 acres, up only 1% from 2023. Prices for peas in the US have generally been lower than in Canada for 2023/24, which could account for the modest acreage increase. Another difference is that the premium for green peas versus yellows have been smaller in the US than Canada, which could mean less incentive to shift acreage toward greens.

If the 2024 pea yield declines to the 5-year average of 1,809 pounds (30.2 bushels) per acre, the US crop would slip to 757,000 tonnes, 8% less than last year, which could require a few more yellow pea imports from Canada in 2024/25. If seeded area has shifted to green peas, the US could become a larger competitor in those export markets.

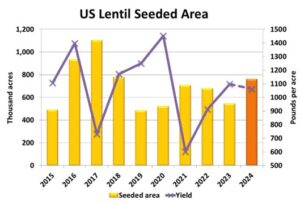

The USDA is indicating that US farmers will be sharply boosting their lentil acreage in 2024. Seeded area is estimated at 762,000 acres 40% more than last year and the largest acreage since 2018. Roughly three-quarters of US lentils are medium greens, which have seen very strong price performance in 2023/24.

Even if 2024 lentil yields slip back to the 5-year average of 1,063 lb/acre, US production would rise sharply to 339,000 tonnes, 30% more than last year. Because most of these lentils are medium greens, the increase production would mean stronger competition in export destinations that can utilize various sizes of greens. In fact, global supplies of green lentils could start to feel heavy if the weather cooperates.

It also appears that US farmers will be increasing their chickpea acreage in 2024. The USDA is estimating seeded area at 429,000 acres, 15% more than 2023. There has been a lot of variability in US chickpea yields in the last few years but the 5-year average yield of 1,277 lb/acre would mean a 2024 US chickpea crop of 241,000 tonnes, 12% more than last year and the largest crop since 2019.

The USDA is forecasting an increase for 2024 dry bean acreage. Seeded area is forecast at 1.32 mln acres, 12% more than last year but 4% below the 5-year average. The USDA doesn’t show seeded area by type in this report, but demand for pintos and blacks has been particularly strong and should attract more acres. If the 2024 yield slips back to the 5-year average of 1,921 lb/acre, production would end up at 1.1 mln tonnes, 2% more than last year.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.