Pulse Market Insight #250 APR 12 2024 | Producers | Pulse Market Insights

New-Crop Pricing Transition

Even though there are still three months left in the 2023/24 marketing year, most of the focus is on next year’s crop. Most of last year’s crop has already been sold but some farmers are still holding old-crop supplies that need to be marketed. At this time of year, the opportunities and risks for remaining old-crop supplies are magnified.

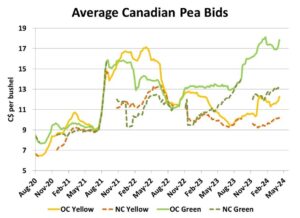

The relationship between old-crop and new-crop bids is an important signal about how much risk and how much opportunity is left as the marketing year winds down. In general, a large difference between price levels means greater risk for remaining old-crop supplies. In 2023/24, prices for some pulse crops experienced extreme highs, which add to the vulnerability as the year winds down with the risk of a sharp drop outweighing the potential for higher prices.

Old-crop prices for green peas are still running close to record highs at nearly $4.50 per bushel higher than the average new-crop bid. Once buyers have enough green peas to fill remaining sales, old-crop bids will drop toward new-crop levels, a sizable risk for anyone still holding onto green peas. Lately, we’ve noticed some buyers are more aggressive than others, a sign that fewer export sales are still on the books and a transition lower could happen sooner than later.

For yellow peas, the differential between old-crop and new-crop bids isn’t as large but the $2.00 spread is still noteworthy. Prices for old-crop yellow peas have moved higher with India back in the market but so far, that influence hasn’t extended into 2024/25, making the longer-term outlook very uncertain. There’s plenty of risk and opportunity for yellow peas.

There’s a big difference in the risk/opportunity outlook for green versus red lentils. Bids for large and small green lentils are still hovering around all-time highs, although some cracks are starting to show. The spread between old-crop and new-crop large green lentil bids is very wide at roughly 25 cents per pound. As soon as buyers have enough supplies to manage until the 2024 crop is available, old-crop prices will come down and the move will likely be sudden.

For red lentils, it’s a very different scenario, with only a small spread between old-crop and new-crop bids. While there doesn’t seem to be much opportunity for an upside move, there’s also less risk of old-crop prices dropping.

For all crops, there’s always a chance that old-crop bids could see one last run higher before the shift to the new marketing year, but that window is starting to close. The higher the price, the more room it has to fall once the shift happens. And there’s usually not much time to react once it does.

As always, new-crop outlooks at this time of year are based on average yields and decent crops but “average” doesn’t actually happen that often. Crops can be damaged by drought or disease and the low supplies will turn a market higher. But the opposite is just as likely and a good yield outcome will weigh on prices. At the risk of stating the obvious, there are no certainties in crop marketing.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.