Strong Start for Pulse Exports Needs to Continue

Pulse crops were among the best performers in a year of surprisingly good yields. In September, StatsCan raised its 2025 pea, lentil and chickpea yields compared to August. The provincial crop reports from Alberta and Sask Ag have also boosted yield estimates this fall, in some cases by a lot. According to StatsCan (so far), combined 2025 production of peas, lentils and chickpeas is roughly 6.9 mln tonnes, up 1.2 mln tonnes from last year. And using provincial crop report yields, the total 2025 crop could be closer to 7.9 mln tonnes. That’s a lot more pulses that need to be exported or processed within Canada.

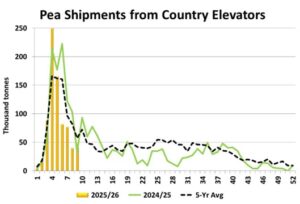

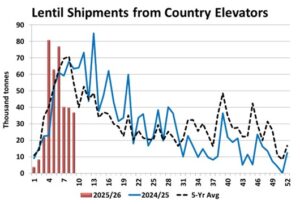

We follow the weekly grain handling data from the Canadian Grain Commission for clues about the movement of crops through the export pipeline. Through the first few weeks of 2025/26, those signals have been mostly positive, but not spectacular. Keep in mind, not all movement is reported by the CGC; only bulk exports are shown, not container exports. Still, the year-to-year comparisons are useful.

As of shipping week eight, bulk pea exports were 626,000 tonnes, running ahead of last year at 599,000 and the 5-year average of 538,000 tonnes. We expect this strong start is largely driven by quick movement to India and other south Asian destinations. This is good news, especially with China’s 100% import tariffs still in place.

While the export numbers show what has already been moved outside our borders, two other CGC measures are leading indicators of whether that export pace will continue. Farmer deliveries are the earliest indication of how strongly peas are being pulled into the export pipeline. Farmer deliveries of peas always spike at harvest and at the start of 2025/26, those volumes were solid again. In more recent weeks though, pea deliveries dropped more sharply than usual. It’s a similar picture for shipments out of country elevators, which spiked earlier but have since dropped below average. Both indicators suggest a quieter-than-usual export movement ahead.

It’s a similar picture for lentils, with year-to-date bulk exports of 264,000 tonnes, ahead of last year at 181,000 and the 5-year average of 215,000 tonnes. A stronger-than-usual start is important for 2025/26, especially with a record lentil crop expected in Australia later this year.

Just like peas, farmer deliveries of lentils also tend to spike in the first few weeks of the marketing year, followed by a quick drop in volumes. Deliveries were impressive in late August and early September but in more recent weeks, have already dropped below average levels. Similarly, shipments of lentils out of country elevators were very strong a few weeks ago but seem to have run out of steam more recently. This is a caution that exports will be quieter than usual in the weeks ahead.

This year’s bigger pulse crops mean exports will need to increase in 2025/26 and a large portion of export programs are already set within the first 2-3 months of the marketing year. It’s always possible the export market could improve later in the year, especially if low prices spur more demand. For peas, a sizable pickup in exports would need China withdrawing its import tariffs. A poor Indian rabi pulse crop could also increase demand for Canadian lentils and peas. That said, there are no indications of either of these things happening.

There are also risks that demand could be reduced, particularly if the Indian government decides to raise or impose import tariffs on one or more pulses. This means a marketing plan for pulses in 2025/26 should include some optimism, but also a good dose of realism. A certain amount of patience wouldn’t hurt either.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.