Pulse Market Insight #166 APR 2 2018 | Producers | Pulse Market Insights

What’s Up With Fababeans?

On the road this winter, I’ve gotten lots questions about fababean markets. Despite the increased interest, I’m not sure that this will translate into increased acreage in 2018. For the most part, it seems farmers are mostly looking for alternative pulse crops due to challenges with marketing peas and lentils into India. Fababeans’ resistance to certain diseases and better performance under wet conditions are also factors.

As with any newish crop, fababeans face a bit of a catch 22 challenge when it comes to marketing. Processors and buyers would like to see more acreage before investing in the crop while farmers would like to see some assured markets before putting the crop in the ground. Until one of those two things happens, there’s certain amount of risk in growing or buying fababeans. To take things to the next level, a few players need to stick their necks out and take on that risk.

Until then, it’s worth reviewing (and updating) where Canadian fababeans are going and how they’re used. The major outlet has been into the feed channel in western Canada. Even in the busier export years of 2014/15 and 2015/16, over 80% of Canadian fababeans stayed within our borders. That will likely remain the case for the foreseeable future, which will provide a steady outlook for the zero tannin beans, the preferred type.

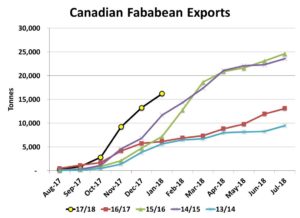

When it comes to exports, Egypt is the main market for Canadian fababeans, although smaller amounts also go to the US. Until recently, the conventional wisdom has been that Egyptian buyers are only interested in large sized tannin types, but this year has seen a shift. While some of that demand still exists, some Egyptian traders have been asking for and buying zero tannin (white) fabas from Canada. When I checked in with a key contact in Australia (the largest fababean exporter), it turns out Egypt normally buys white types from there. This suggests the largest market demand (both domestic and export) is focused on white fababeans.

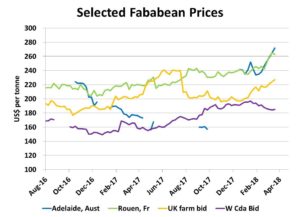

Prices for fababeans have been trending higher stronger in most markets, aside from western Canada. Largely, that’s because the larger Canadian market for domestic use is tied to prices for feed peas, which have been fairly stagnant. It’s also worth noting that as prices rise in overseas markets, farmers there will be encouraged to plant more fababeans in the next month or two, which has the potential to cause the 2018/19 market to flatten out.

Here in western Canada, the coffee shop talk suggests fababean acreage in 2018 will be flat to lower. Part of the reason is the disappointing crop outcomes, especially in the eastern half of the prairies, something that also afflicted soybeans. Our gut feeling is a little more optimistic, that seeded area will be more or less steady this year.

For 2018/19, our price outlook is also steady. The large supplies of yellow peas in western Canada will keep the feed pea market from showing much strength and that will limit the opportunity for fababeans as well. As mentioned above, increased plantings in other exporting countries will provide plenty of competition for the Egyptian market and keep that market under pressure.

As we’ve mentioned numerous times in the past, improved opportunities for fababeans would need to come from domestic processing, particularly fractionation. That would unlock fababeans’ value from its higher protein content, especially in the non-feed market channel. This processing could also occur in the US, which would still provide an additional outlet for Canadian fababeans. In either case, these opportunities won’t show up immediately and are longer-term possibilities.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.