Pulse Market Insight #134 JAN 18 2019 | Producers | Pulse Market Insights

Should I Sell or Should I Hold?

Pulse prices have started to edge higher in the past few weeks. It’s not a screaming rally by any means but after the earlier doom and gloom, a couple of extra cents for lentils or another two bits for peas look pretty good. There are a few reasons behind these gains but the concern about Indian rabi (winter) crops is one of the main drivers. While making marketing decisions based on possible weather outcomes can be a little dicey, this does raise the possibility of further gains.

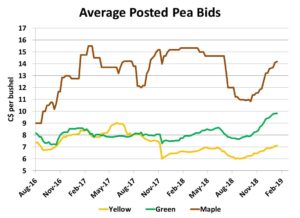

That said, it’s also important to note that it’s not just the Indian situation behind some of this strength. Prices of peas have already been moving higher even without an increase in India demand. Record purchases by Chinese buyers have provided most of the price support. Current diplomatic relations between China and Canada are adding a little risk to this situation.

When prices start to move higher, especially at this time of year, farmers have two choices. They can follow through on a previous “commitment” to sell if only prices would go back up by _____ amount. Just as often though, a rally can also cause the locks to go back on the bins and target prices to get bumped even higher. Ultimately though, the correct decision is only known after the fact.

Most times, the questions I get are about when to sell. Even though it may not be meant that way, the question often comes across as an all-or-nothing decision. But it’s rare that someone should sell their entire crop with a single decision. There’s simply no way to predict future events well enough to know with certainty how things will pan out.

That said, there are good reasons to sell some pulses now. One longstanding marketing maxim is to sell into rallies. That’s not to say it should all be sold in one shot. Selling incremental amounts as prices move higher lets farmers lock in profits, rather than leaving it all unpriced and open to downside risks.

What are some of those risks? Weather events can either help or harm the price outlook. There is a chance (albeit small) that conditions could still recover in India and limit the expected crop losses and allow the government to maintain trade barriers. Geopolitical developments in both India and China are highly unpredictable and could damage opportunities for Canadian pulse exports.

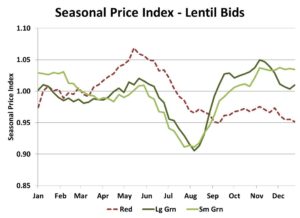

There are also reasons to leave some of the crop unpriced. One of these is the seasonal price tendencies for some crops. There’s no guarantee that prices will follow these tendencies and not all seasonal patterns are positive. For example, seasonal price patterns are friendlier for red lentils going into the spring while greens don’t tend to show the same strength. For both yellow and green peas, there’s a small seasonal tendency to go higher early in the calendar year but then they turn sideways before heading lower in early summer.

Another marketing maxim is that “the trend is your friend”, which is a way of saying that market forces (in this case positive) behind the trend are more likely to continue in the same direction rather than reverse. Strong Chinese demand for peas is fairly well established and is more likely (but not guaranteed) to remain in place. Concerns about Indian pulse crops are getting closer to being locked in rather than improving.

Our overall view is that while fundamentals are supporting stronger prices, these aren’t a sure thing, as we’ve seen in the last couple of years. We lean toward leaving more of the crop unpriced into the second half of the marketing year but it’s still prudent to make a few small sales at current prices to mitigate some of the risks.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.