Pulse Market Insight #137 MAR 1 2019 | Producers | Pulse Market Insights

Quiet New-Crop Price Signals

By this time of year, price signals for the coming year are usually quite well-established and most of the planting decisions have been locked in. That’s not the case in 2019. While new-crop prices for the major grains and oilseeds have been widely available for a number of months, bids for most pulses are still few and far between.

There’s good reason for this slow rollout of new crop pricing; Canadian pulse traders and processors typically depend on commitments from overseas buyers to set the tone for the fall. While there are some sales going on for fall shipping, this trade seems quite limited. And after the market turmoil of the last 18 months, traders are understandably hesitant to stick their necks out without firm commitments.

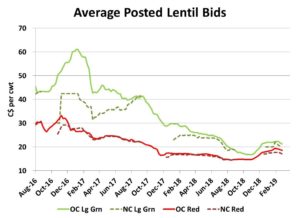

The greatest amount of uncertainty appears to be in yellow peas and red lentils, the two largest classes of pulse crops grown and exported from Canada. These are also the two crops most heavily dependent on Indian demand and are highly vulnerable to seemingly arbitrary shifts in Indian government policy. India remains the main factor for red lentils but in 2018, China has become the dominant buyer of yellow peas but there are also concerns about the stability of Chinese demand.

Because the Indian situation is still up in the air, buyers there simply aren’t willing to commit to large purchases of red lentils and yellow peas for fall shipping. This also means Canadian traders aren’t prepared to step out on their own with large contracting programs.

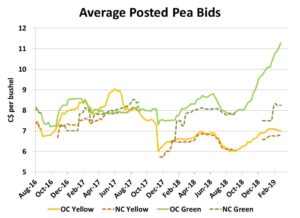

That’s not to say there aren’t any new-crop bids for yellow peas or red lentils, but they aren’t widespread and aren’t very aggressive either. Average yellow pea bids for fall delivery are around $6.75-7.00 per bushel, a little below spot prices. For red lentils, the average new-crop bid seems to be around 17 cents per pound, about 1½ cents lower than the average spot price.

Interestingly, some of the more consistent new-crop bids have been in the smaller classes of pulses, including green peas and green lentils. That’s because buyers other than India are ready to step up and lock in supplies of these pulses. New-crop bids for green lentils aren’t spectacular by any means, but they have generally been more widely available than for red lentils, signifying that sales are being made for the post-harvest period.

For green peas in particular, the strong rally in old-crop prices is a clear signal that Canadian supplies are running low and more acres are needed in 2019 to meet demand. New-crop bids averaging $8.25 per bushel are well below the spot price but are still historically attractive and could encourage more planting or simply cause a shift from yellow to green pea production.

New-crop bids are also available for kabuli chickpeas but because of heavy supplies in Canada and the US, price levels are still at a multiyear lows and won’t do much to attract extra acres. Dry bean bids are relatively solid but with prices for most classes close to old-crop levels, they don’t seem to be exhibiting an urgency to buy extra acres in 2019.

With this less robust new-crop bidding in 2019, planting decisions will be based more on rotational considerations and “market opinions/hopes” than on actual bankable prices and contracts. It also seems clear there will be less forward contracting by farmers than usual, which raises the possibility of more volatile prices once the 2019/20 marketing year arrives. If crops are fairly large, heavy farmer selling could accentuate the harvest lows but a smaller crop and a flurry of export buying could drive the highs higher than usual in order to trigger farmer selling.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.