Pulse Market Insight #141 MAY 10 2019 | Pulse Market Insights

So What Do StatsCan Stocks Numbers Tell Us?

One of the most underwatched sets of StatsCan estimates is the March 31 Stocks Report. And yet it can sometimes yield helpful information about crop supplies heading into the home stretch of the marketing year, and a few clues about the carryover into next year.

Over the last year or so, pulse markets seem to have developed a doom and gloom outlook, and rightfully so. Exports have suffered and supplies have been heavy. But as always happens, there is a turning point and often, the negative sentiment keeps people from seeing the change coming. The question is whether pulses are getting close to that point, and these March 31 stocks numbers can help provide an answer.

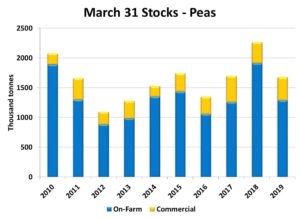

For peas, StatsCan pegged the March 31 stocks at 1.68 million tonnes. While that’s not exactly tight, pea supplies at the end of March were 580,000 tonnes (26%) less than last year and back within the realm of normal. This suggests the era of burdensome pea stocks is over, at least for now.

Even though pea supplies at the start of 2018/19 were only a bit lower than the year before, exports for Aug-Mar were up 17% and domestic use was up 30%, helping draw down inventories. While the export data is well-established, the domestic use total is a little hazier. We’re still not sure whether this larger domestic consumption is related to new processing facilities, increased feed use or is simply statistical wiggle room. In any case, the stocks of peas carried over into 2019/20 will be lower, and that will help offset the larger crop (with average yields) expected this summer.

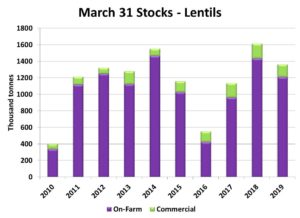

The stocks situation for lentils isn’t quite as friendly as peas, but is better than last year. StatsCan has estimated March 31 stocks at 1.36 mln tonnes, down 250,000 tonnes (15%) from last year. That’s not exactly tight, but is a move in the right direction and should mean ending (July 31) stocks will be down as well.

With all the doom and gloom, it may come as news to people that so far in 2018/19, Canadian lentil exports were up 42% from last year. That’s enough of an increase to offset the larger supplies at the beginning of 2018/19, even though domestic use is lower than a year ago. In any case, the reduced old-crop stocks will keep a lid on 2019/20 lentil supplies, especially with a decline in seeded area this spring.

For chickpeas, the stocks data was not positive. As of March 31, StatsCan showed chickpea inventories at 226,000 tonnes. There wasn’t an estimate from StatsCan last year to compare against, but whatever the measure, this is a very large stockpile of chickpeas. Even with a drop in chickpea acres this spring, the old-crop carryover into 2019/20 will be big enough that next year’s supplies will be even larger than this year.

Of course, this is just one part of the outlook. There’s still plenty of uncertainty about export possibilities in 2019/20. Will Canada get shut out of India (again) or China? That’s harder to predict but from the supply perspective, this March stocks report is offering glimmers of hope for peas and lentils but for chickpeas, not so much.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.