Pulse Market Insight #143 JUN 7 2019 | Producers | Pulse Market Insights

Are Pulse Exports Really That Bad?

Ever since (actually before) India started imposing its import barriers, there had been a lot of concern about export potential for Canadian pulses. And there was good reason for that, as India was the dominant buyer for lentils and, to a lesser extent, peas. The loss of that demand did set lentil and pea markets back on their heels. More recently, concerns about Chinese trade tensions have added to the pessimism. Unfortunately, that negative sentiment is still hanging over the market, even though the export numbers haven’t turned out all that bad.

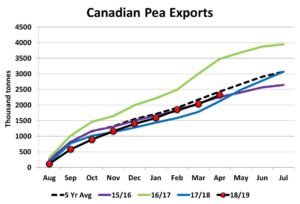

Normally, there’s a big surge in pea exports right after harvest as fresh supplies become available and overseas buyers stock up after a period of low inventories. Most of that big fall shipping program used to be destined for India and in 2018/19, that wasn’t the case. As a result, exports fell behind early and took a while to catch up as Chinese demand was steadier from month to month.

It didn’t take long for 2018/19 exports to catch up to and pass 2017/18 and by April, 2.3 million tonnes of peas had been exported, only a bit behind the 5-year average and actually the third strongest export program on record. It’s not reasonable to compare this year’s exports to the record levels of 2016/17, when all of the stars aligned. But compared to most other years, the 2018/19 performance has been quite positive, certainly not a “doom and gloom” situation.

It’s also worth noting that Chinese pea purchases are ongoing, with another 133,000 tonnes exported to China in April, the highest monthly total since October 2018. That said, we know that this situation could shift quickly. Looking ahead, there are also signals coming from India that import restrictions may be eased. While that may take a few more months to sort out, it adds a little more optimism to the outlook.

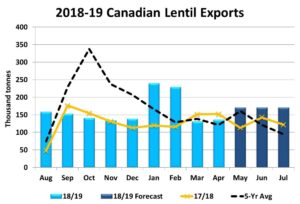

For lentils, there was a larger lull in 2018/19 exports but the second half of 2018/19 is looking more optimistic. Just like peas, lentil exports missed the fall surge and shipments were well below average until January. Since then, monthly lentil exports have been at or well above average, with year-to-date exports at 1.46 million tonnes, 300,000 tonnes ahead of last year’s pace. And there are positive signals for the final quarter of 2018/19.

Unlike peas, lentil exports to India “only” face a 33% tariff and prices there have risen enough to allow Canadian lentils into the country. In fact, the bump in Canadian exports for January and February were mostly related to 70,000 tonnes of shipments to India. Since then, volumes have dropped back to average again but in the past few weeks, Indian lentil prices have moved even higher and that will allow more Canadian lentils into the country late in 2018/19.

Canadian chickpea exports have also risen considerably late in the marketing year. Normally this is a slower season when supplies typically run low, but that’s certainly not the case this year and is allowing a much improved export pace.

Early in 2018/19, the outlook for Canadian pulses was quite cloudy with plenty of doom and gloom from the industry. It’s turning out better than those early expectations and because of the improved performance, the supply situation heading into 2019/20 isn’t nearly as heavy as some have feared.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.