Pulse Market Insight #146 JUL 19 2019 | Producers | Pulse Market Insights

What to Make of the Crop Ratings?

Throughout the growing season, there are plenty of opinions about crop yields and how they will affect the markets. There are also many ways that these opinions are formed. These include comments and pictures on Twitter, analysing satellite vegetation images, conducting informal surveys or the always favourite “windshield crop tour”. Still other groups organize crop tours to get some “in the field” observations. Then there are the crop reports from provincial ag departments which assign ratings from crop observers across a wider geography.

I try to use as many of these methods is possible but in the end, they all boil down to guesstimates or, to put it more politely, “educated assessments”. There are benefits and pitfalls to each method. Despite some criticisms, we find the provincial crop reports give the broadest and most objective view of crop conditions. Later in the year, these crop reports provide actual yield estimates and we’ve found these are relatively reliable. In the meantime though, we need to interpret the crop ratings to come up with our own yield guesstimates and supply implications.

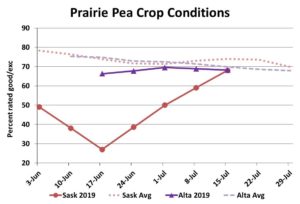

Because there is large pea acreage in both Alberta and Saskatchewan, crop reports from both provinces are equally important. So far in 2019, crop ratings have been much more positive in Alberta as the central regions, where pea acreage is most heavily concentrated, had much more favourable conditions than large parts of Saskatchewan. Crop ratings started the year a little below average but have improved since then with 68% of the crop either good or excellent as of mid-July. In Saskatchewan, ratings have climbed sharply from a dismal start and are also at 68% good/exc, approaching the long-term average.

Over the years, we’ve noticed that it’s not just the absolute “good/exc percentage” that matters when looking at yield potential. It’s also whether the conditions have been improving or deteriorating, especially later in the season. This year, it’s clear that the crop, at least in Saskatchewan, has been getting better as the season has gone on.

With crop ratings close to the long-term average and rising, we think it’s more likely that the prairie-wide pea yield will end up at least at the 5-year average of 36.9 bu/acre, or possibly above. That’s quite a turnaround from earlier ideas of a poor 2019 outcome. If so, this would mean a 19% increase in the 2019 crop, compared to last year’s low point. Part of that larger crop would be offset by the lower old-crop carryover but 2019/20 supplies could still top 4.5 mln tonnes, 300,000 more than 2018/19 and a bit more than the 5-year average of 4.35 mln tonnes. That’s not really negative for the price outlook, but takes a bit of the edge off our enthusiasm for next year.

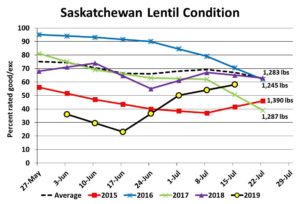

For lentils, Saskatchewan dominates the acreage picture, making the conditions there much more important. That’s not to say the ongoing drought conditions in southern Alberta aren’t an issue, but they’ll have less impact on the prairie-wide yield total.

The lentil ratings in Saskatchewan also show a steady improvement since mid-June, which suggests yields will end up better than expected earlier in the summer. Once again, we emphasize that the direction of the trend is just as important as the final number. It’s worth noting that in the past four years, the highest lentil yield occurred in 2015, which had some similarities to 2019 with a very dry start and a late crop-saving rain. Partly, that may be related to lack of disease pressure earlier in the year due to the dryness.

We know that the lentil growing region in Alberta is in much worse shape and will drag down the overall yield to some degree. As of mid-July, only 30% of Alberta lentils were in good or excellent condition. But based on these latest improvements in Saskatchewan, odds are that the Canadian lentil crop will at least hit the 5-year average yield of 1,330 lb/acre (22.2 bu/acre), if not more. If so, the 2019 crop would come in at roughly 2.2 mln tonnes, 150,000 tonnes more than last year, but that wouldn’t be enough to completely offset the smaller old-crop carryover. As a result, 2019/20 supplies could still end up smaller than the last few years which would be generally favourable for the price outlook.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.