Pulse Market Insight #147 AUG 16 2019 | Producers | Pulse Market Insights

Where Will All the Peas Go?

Here in western Canada, we spend a lot of time thinking about how big the pulse crops will be; and rightfully so. Canada still dominates the global pulse trade and supplies here are a huge factor in setting the market direction.

There’s no question the 2019 Canadian pea crop will be big; it’s just a question of how big. Earlier this summer, the StatsCan survey results showed seeded area of peas would be a new record of 4.3 mln acres. That’s pretty impressive, considering yellow pea prices were (and still are) in the doldrums when farmers were making planting decisions.

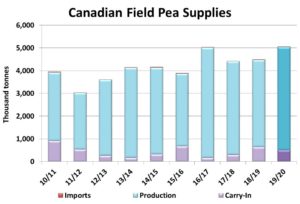

Later this month, StatsCan will issue the first yield survey results but we’re already getting some pretty positive reports, after the worrying start to the growing season. If the western Canadian yield ends up 5% above average, it would mean a 4.5 mln tonne crop of peas, which could result in record pea supplies of 5.0 mln tonnes for 2019/20. If that’s the case, the export and domestic use side of the balance sheet becomes even more important.

Those big supplies may seem daunting, especially in light of the trade disruptions and uncertainties, but we remain fairly optimistic that they won’t end up being burdensome. We’re expecting to get a bit of help from a modest increase in domestic use for 2019/20 as some new plant processing capacity comes on stream. That said, the bigger impact won’t show up until the next marketing year.

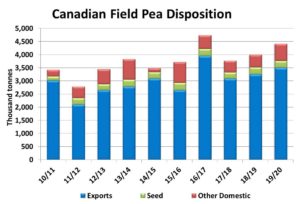

The focus will still be on the export market and even there, a big improvement in export demand isn’t needed to keep supplies under control. Our forecast for exports to India is still very cautious at only 300,000 tonnes, in line with the previous two years, so our estimates aren’t counting on a return to normal trade with India.

We’re also not expecting a big increase in pea shipments to China next year. Exports haven’t really been affected by the diplomatic tensions and the trend in Chinese pea processing is still higher, meaning that our 2019/20 export forecast of 1.65 mln tonnes could actually be conservative. Of course, there still is a risk that the trade dispute could escalate, which would throw a large wrench into the outlook.

Other countries have also seen improvements. The largest change in 2018/19 was Bangladesh, which has taken more than 600,000 tonnes, but it’s not clear if all of those peas are remaining within its borders. The US has also been picking up decent volumes, although its own pea crops are also expanding.

Overall, we don’t think it’s a stretch to expect near-record pea usage in 2019/20, which will go a long way toward chewing through the large 2019 crop. There are still some risks in the market but there’s also potential for increased usage. For example, we’re not expecting much from Indian demand but if it starts to ease its import restrictions, the comfortable supply situation could shift toward a friendlier outlook for peas.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.