Pulse Market Insight #148 AUG 30 2019 | Producers | Pulse Market Insights

What Did Farmers Tell StatsCan?

The recent StatsCan yield and production report provided a bit more direction for pulse markets but should really still be seen as a trial balloon. The survey was conducted from early July to early August, before any of the crops had been harvested and even seasoned crop watchers are just offering educated guesses rather than actual harvest results. Plus, most farmers don’t want to be too optimistic when talking to StatsCan. As a result, there’s a chance subsequent crop estimates will go up a bit.

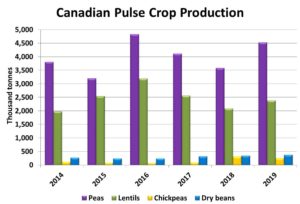

In general, there weren’t big surprises in StatsCan’s pulse production estimates, with the pea and lentil projections close to traders’ ideas. The yields also confirmed how well crops responded to the June rains, especially in Saskatchewan, after an exceptionally dry start to the growing season.

According to the StatsCan survey results, the 2019 pea yield is 39.1 bu/acre, down slightly from 39.8 last year but above the 5-year average of 37.4 bu/acre. This solid yield, in combination with record 2019 pea acreage put the crop just over 4.5 mln tonnes, almost 700,000 tonnes (18%) more than last year.

Next week, we’ll find out StatsCan’s estimate of July 31 pea ending stocks but we expect that number to be fairly comfortable, possibly around 500,000 tonnes. If so, that would mean 2019/20 pea supplies could top 5.0 mln tonnes, a new record. As we reported in the last Pulse Market Insight, those kind of supplies are manageable even with only small exports to India. That said, it’s a little harder to justify a meaningful rally based on these stockpiles.

The lentil yield of 1,417 pounds (23.6 bushels) per acre was surprisingly aggressive, given that it would be the highest since 2014. This bumps the 2019 crop up to 2.38 mln tonnes, a little higher than the average trade estimate of 2.3 mln tonnes and almost 300,000 tonnes more than last year.

With this size of crop, 2019/20 lentil supplies would now be just slightly lower than last year. But even with flat export trade, ending stocks should see a decline and allow some modest price improvement later in 2019/20.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.