Pulse Market Insight #152 OCT 25 2019 | Producers | Pulse Market Insights

What Kind of Signals Are Coming From India?

There’s been a lot of digital ink spilled about developments in Indian pulse markets over the last two years but it seems a lot of the noise has subsided. That doesn’t mean the situation has gotten any better but simply that the market has adjusted to the new reality that exporting pulses to India is a lot more costly and difficult.

Even though India isn’t front and centre anymore, it’s still an important market. India is buying decent volumes of lentils and a few peas from Canada (and other origins) and still has an impact on the market. As such, it’s worth looking at some of the latest Indian developments for clues for market direction in 2019/20.

Weather events are always important for India. In early summer, the kharif pulse crop looked like it was in big trouble due to lack of rainfall but, just like western Canada, the situation went from one extreme to the other and excess moisture became a problem. In some areas, kharif pulse crops have been damaged by the heavy monsoon rains but the extent of the problem hasn’t been nailed down. Losses to the tur (pigeon pea) crop could support larger imports of Canadian green lentils as a substitute, but the amounts could be limited.

On the other hand, the heavy rains late in the monsoon season will provide a good start for November plantings of rabi pulses, which include chickpeas, peas and lentils. It’s still far too early to draw conclusions but a favourable rabi crop would put a damper on prospects for Canadian exports later in 2019/20.

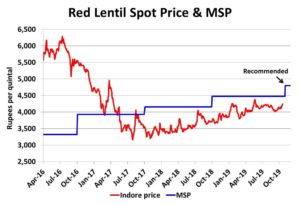

Aside from the weather, the Indian government is still actively intervening in pulse markets. As it has been doing for years, the Indian government recently raised the Minimum Support Price for Indian farmers planting the next lentil and chickpea crops. The MSP for red lentils was raised to 4,800 rupees per 100 kg from 4,475 rupees last year while the desi chickpea MSP went from 4,620 to 4,875 rupees per 100 kg.

These MSPs remain well above the actual market price and many Indian farmers view them with skepticism as the government only buys a limited amount of the crop at these levels. Even so, they can be seen as incentives to plant more of these pulses. As such, they set the stage for increased acreage and larger production, which would mean lower import requirements, if the weather cooperates.

As global markets have “adapted” to the new trade environment in India, pulses continue to flow into the country and because of that, there are now rumblings of increased import barriers. Some rumours are circulating that the current 30% tariff on lentil imports could be raised significantly and quantitative restrictions are also possible. Restrictions on pea imports could also be tightened up to close the border further.

These changes would be negative from a short-term perspective, but they also clearly signal that the Indian government is determined to boost domestic production of pulses at the expense of imports. Unfortunately, this longer-term plan by the Indian government seems to suggest it will not return to the “glory days” of huge purchases, unless adverse weather forces them to boost imports. This reinforces the need for Canada’s pulse organizations to continue their focus on market diversification.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.