Pulse Market Insight #154 DEC 6 2019 | Producers | Pulse Market Insights

Quality Issues in 2019 Pulse Crops

Even in early December, some cereal and oilseed crops are still in the field but almost all pulses are in the bin. While pulses are in a better position than some other crops, the delayed harvest has resulted in quality challenges, which could have some impact on the export outlook.

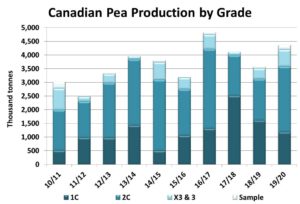

It’s difficult to nail down the exact grade profile of each year’s crop. The CGC harvest sample program is helpful but its numbers are based on the samples that farmers choose to send in and it’s unlikely to reflect the total crop. Over time, we’ve used the grade breakdowns in the late season crop reports from Alberta and Sask Ag to develop a picture of the crop quality.

For peas, these reports tell us that 25-30% of the 2019 crop ended up as a 1Can, compared to the 10-year average of 35%. Another 55% of the crop is reported as a 2Can, which is roughly in line with the average while 14% is estimated as an X3 or 3Can and 4% as Sample grade. Of course, this doesn’t tell us how the grades turned out for the yellow and green portions of the pea crop but it’s safe to assume that green peas faced more challenges due to the more stringent quality specs.

The overall picture shown in the chart isn’t meant to minimize the impact of quality losses on individual farms. But from the perspective of export capabilities, this year’s outcome is hardly seen as a disaster. Generally, the 2019 quality is close to average and shouldn’t limit potential, at least for yellows. The more serious quality concerns for green peas have certainly limited available supplies and caused prices to spike.

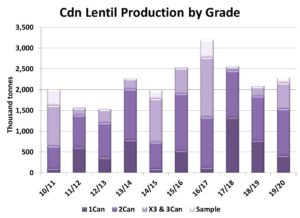

When it comes to lentils, it appears there was more damage from the harvest delays. Of course, it depends on whether you compare this year’s performance to the previous two positive years or against the severely damaged crops of 2016 and 2014. According to Sask Ag, 18% of lentils in 2019 were a 1Can compared to the 10-year average of 27%, 49% were a 2Can, 27% as an X3 or 3Can and 6% ended up as Sample.

Just like for peas, the overall grade profile disguises the greater impact on green lentils, due to more stringent requirements for colour. This is a key reason why green lentil bids have shown a larger response this fall. In general, while the lower quality of the 2019 lentil crop adds some challenges to the flow of exports, the issues aren’t large enough to severely restrict export flows, especially for red lentils.

The quality of the 2019 chickpea crop was also reduced, with nearly a quarter of the crop grading as Sample. Even so, large supplies of good quality chickpeas were carried over from 2018/19, meaning that total 2019/20 supplies will be sufficient to meet export demand. That’s cold comfort to those farmers who struggled with low-quality chickpeas.

Of all pulse crops in 2019, dry beans likely experienced the worst delays, especially in Manitoba. While we don’t have actual estimates of the crop quality, we expect these losses will have a large impact on dry bean export potential, especially for pintos and navies, in 2019/20.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.