Pulse Market Insight #164 MAY 29 2020 | Producers | Pulse Market Insights

What to Make of New-Crop Price Spreads

At this time of year, farmers are heavily focused on all the activities and decisions around seeding, and rightfully so. But there are also some looming choices to be made about marketing. The late Kenny Rogers may have been referring to something else but his words about knowing when to hold ‘em and when to fold ‘em also apply to the decision about marketing the rest of last year’s pulse crop now or later.

There are a lot of factors to weigh in selling the last bits of the 2019 crop now or holding into next year. Cash flow needs, bin space and how the 2020 crop is shaping up are all important considerations, but are specific to each farm operation. The attitude toward risk and opportunity also factors into decisions, but that’s also an individual mindset. Outlooks for the last few months of this marketing year and the next one add more issues to think about.

One of the simplest but (in our view) most helpful measures is the spread between old-crop and new-crop prices. These will provide a reasonable “feel” for the market environments in the two marketing years. Besides the actual spread, the momentum or behaviour of both old-crop and new-crop bids as this year’s crop goes in the ground provides other clues.

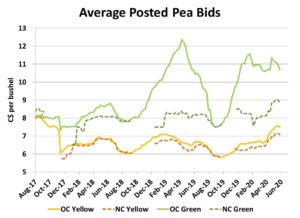

Looking at bids for peas, we see two very different situations. For yellow peas, the spread between old-crop and new-crop bids is less than 50 cents per bushel. That tells us “the market” views supply/demand dynamics very similarly for the rest of 2019/20 and into early 2020/21. It also says there’s limited downside risk (aside from possible actions by China) from holding 2019 yellow peas into the new crop year. For green peas, it’s a different story. The new-crop discount is roughly $1.75 per bushel, a clear signal that the new-crop supply outlook isn’t (currently) nearly as tight as it is now. This also means there’s a lot more risk and a lot less possible reward for carrying old-crop greens into 2020/21.

In addition to the spreads themselves, the price behaviour as the 2020 crop approaches is a useful indicator. After the March/April rally, bids for both old-crop and new-crop yellows and greens have run out of steam and are turning a bit lower. Market disruptions such as 2020 crop problems or unforeseen export sales are always possible and could turn the market higher again, but the fact that upward momentum has faded is a strong indication of overall market sentiment. Once we get further into the 2020/21 marketing year, different dynamics will take over, but this current “tone” is the most likely environment for the last few weeks of 2019/20.

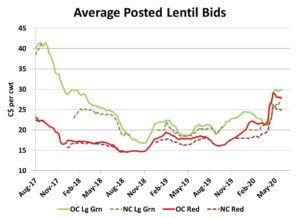

For lentils, the difference between old-crop and new-crop bids has narrowed through the spring months, with both red and large green lentils showing a roughly 3 cent per pound spread. This suggests the supply/demand outlook for 2020/21 is viewed as fairly similar to the current old-crop environment. It also means there’s limited risk (based on the foreseeable future) in holding 2019 lentils into the next marketing year.

Just like peas, the sharp rally in lentil prices has also turned sideways and that loss of momentum makes it less likely to see another turn higher late in the season. That’s not to say individual buyers couldn’t bump up bids to fill a specific export sale, but a broad rally would be more difficult to sustain, at least without threats to the Canadian crop.

The kabuli chickpea market is showing some modest gains lately but remains near the multiyear lows. The spread between old-crop and new-crop bids is almost zero. In fact, the average new-crop bid is slightly above old-crop levels and that means there’s little if any incentive to sell now. Rather, farmers would be better off to hold the 2019 (and maybe 2018) crop into the 2020/21 marketing year. Chances are though, they have already made that decision.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.