Pulse Market Insight #172 OCT 9 2020 | Producers | Pulse Market Insights

What’s Driving Pea Prices Higher?

It seems there are always analysis and opinions about changes in the market. What’s going on out there and what’s behind the moves? Analysts can come up with some interesting theories about the unique factors that are different this year, sometimes forgetting about basic market fundamentals.

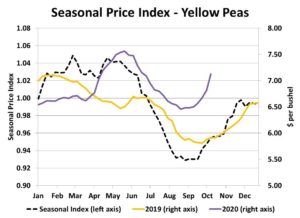

The fact that pea prices are rising after harvest should come as no surprise to anyone. Just like prices decline through the summer, the post-harvest rally is a fairly well-established phenomenon. It doesn’t happen every year, but often enough to be quite predictable. We calculate a seasonal price index for each crop to remind us of these reliable patterns.

Part of the answer of why peas are rallying is simply that the market is doing what it (almost) always does. Prices start declining later in the marketing year and bottom out in mid-August to mid-September when harvest deliveries are the heaviest. It makes perfect sense. Then, when bins get locked, prices need to rise to keep attracting peas into the export pipeline.

So while part of the gains can be chalked up to normal seasonal behaviour, this year is still a bit different as the seasonal rebound seems quicker and stronger than usual. For yellow peas, the average prairie-wide bid has gained 65-70 cents per bushel since the August lows, and more aggressive bids from certain buyers are up quite a bit more. Green pea prices have also recovered but not quite as much, up 45-50 cents per bushel.

We think there are a couple of reasons behind the stronger price response this fall. The first is more opinion than fact, but our view is that farmers weren’t heavily forward-sold on peas heading into the fall. In the spring and even in summer, new-crop bids (especially for yellows) were few and far between and frankly weren’t very exciting. If farmers hadn’t made many sales, then exporters didn’t have a lot of coverage for the fall shipping program. The result is that more aggressive bidding has been needed to attract farmer selling, especially as farmers became more bullish/reluctant this fall.

But while farmer selling was subdued, export demand was strong. India is out of the picture but Chinese buyers have been more active (not just for peas), restocking after a summer lull. Through the first nine weeks of 2020/21, 795,000 tonnes of Canadian peas (not including containers) have been exported to all destinations, the most since the boom year of 2016/17.

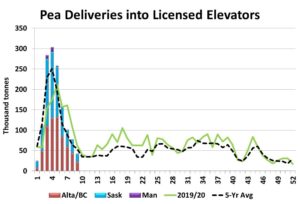

Earlier this fall in the thick of harvest, farmer deliveries were very heavy. In fact, during the first two months of 2020/21, farmers have delivered over 30% of their total pea supplies. That’s a predictable pattern but this year is stronger than usual. The big flow of peas into the system allowed exporters to keep up with demand in the short term, but deliveries have already dropped off, part of the seasonal pattern.

As long as demand keeps up (Chinese buying tends to be year-round), exporters will need to work hard to attract farmer selling. And as farmers get more bullish (especially in the middle of winter), it will require aggressive bids. Again, the seasonal chart provides guidance about price behaviour for the remainder of the marketing year. And based on early performance, this year could be even more exuberant than usual.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.