Pulse Market Insight #175 NOV 20 2020 | Producers | Pulse Market Insights

How Are Lentil Markets Looking?

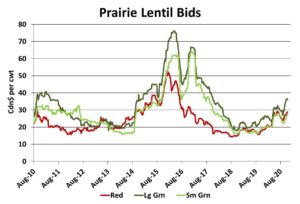

There’s a reason why the title of this article is plural, as in “markets”. We often see the various types of lentils lumped together, as if there is just one type of market, but that’s clearly not the case. Production and consumption patterns are very different and prices of some classes move quite independently. Even though both red and green lentil prices both strengthened this fall, they are as different as oats and flax, which is why we need to look at these two types separately.

From the production side, red lentil output rose in western Canada this summer. We’ll get some updated estimates from StatsCan in early December but early indications have the 2020 red lentil crop at 2.2 mln tonnes, up 700,000 tonnes (46%) from last year; not exactly a tight supply situation.

That’s been okay, since export demand has picked up considerably, not just from India but also from other key customers such as Turkey and the UAE. This is keeping Canadian exports flowing well early in 2020/21 and has provided the lift for prices. Prices are also being supported by disciplined farmer selling, holding out for stronger bids.

A couple of developments on the horizon have the potential to keep a lid on red lentil prices however. The Australian harvest is going on now and will start hitting the market soon. The range of production estimates though is extremely variable, from an early forecast from Pulse Australia at 358,000 tonnes, to the ABARES’ September forecast just under 500,000 tonnes and more recent private estimates of 600,000 tonnes. And this week, someone posted a forecast of 1.0 mln tonnes, although that seems a stretch. We also know the official estimates from ABARES have been far too low for several years now. Regardless of the exact size of the crop, Australian lentils (mostly red) are poised to start hitting export markets in the next couple of months.

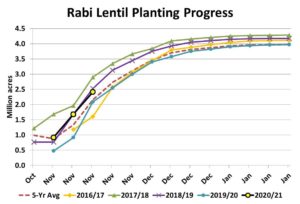

After the Australian crop, India’s rabi production will become available in February or March. Planting is well underway and is running ahead of last year and the 5-year average. One prediction from the Indian Ag Minister is a lentil crop (nearly all red) of 1.6 mln tonnes, up from 1.2 mln last year but of course, the weather will need to cooperate. This still wouldn’t be enough to meet all of India’s lentil needs but has the potential to trim import requirements in 2021.

The combination of sizable Canadian supplies, a soon-to-arrive Australian lentil crop and the potential for more Indian production will tend to blunt the red lentil rally. That’s not to say there’s no more upside, but it’s a little less buoyant outlook than for greens.

The varying sizes of green lentils also have distinct markets, although substitution can take place, which is why we’ve grouped them together. The big difference for green lentils is that Canada and the US are the two major exporters and producers. Both of those harvests are already in the books and there won’t be any fresh supplies until next fall.

The US lentil crop (mainly medium greens) is up roughly 20% from last year while Canada’s 2020 green lentil harvest could be slightly smaller than last year. Supplies are also by much lower old-crop carryover from the previous year. This has set up the tighter supply situation in 2020/21.

Another significant difference for green lentils (compared to reds) is that demand is more price inelastic; buyers are less likely to be scared away by higher prices. This firm demand means there’s more upside potential. Plus, Canadian exports of green lentils are more broadly dispersed than reds. India is still a major buyer of greens but there are numerous other countries in many regions that there’s less risk from losing a single large customer.

Price behaviour shows the strongest demand among this class is for large greens, but the substitution effect is also pulling small and medium greens higher as well. Even though this year’s rally has been very positive, it still pales in comparison to previous markets. That said, circumstances this year don’t seem quite as bullish (especially for reds) as 2015/16 and 2016/17 when India had two successive droughts.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.