Pulse Market Insight #179 FEB 5 2021 | Producers | Pulse Market Insights

StatsCan Stocks Implications

Most years, the StatsCan December 31 stocks report doesn’t get a lot of attention. This year however, is a little different as there are more concerns about shrinking inventories (for many crops) and whether supplies will be large enough to meet demand for the rest of the year.

To get a handle on crop supplies, StatsCan has surveyed 8,600 farmers between mid-December and mid-January to come up with their estimates. As long as they get reliable answers, the stocks report should be a decent picture of available supplies. StatsCan also issues an S&D for each crop as of December 31 which tries to sort out how much of each crop has been exported, with the remainder assigned to domestic use. It’s not ideal, but it’s better than the alternative – guessing.

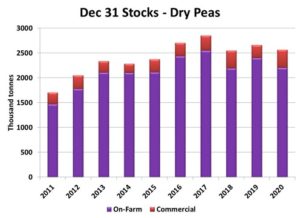

For peas, StatsCan pegged December 31 stocks at 2.57 mln tonnes, roughly 100,000 tonnes less than a year ago. Compared to the last 10 years, that’s not exactly tight and those comfortable supplies seem to be at odds with the strength in the market, especially for yellow peas. This fits with StatsCan’s production estimates, which showed more green peas being grown while the yellow pea crop was up just marginally.

The reason why the market can keep rallying with seemingly adequate supplies is that the pace of usage has been extremely heavy so far in 2020/21. The StatsCan report shows the combination of export and domestic use for Aug-Dec has been nearly 2.3 mln tonnes, 20% ahead of last year and just behind the previous record in 2016/17. The strength in pea prices reflects the fact that this pace will need to slow down or Canada will run out by the end of the year. In other words, demand needs to be rationed.

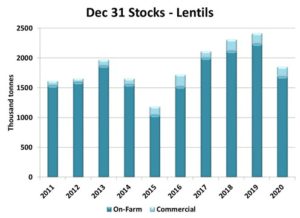

In the case of lentils, StatsCan is showing December 31 stocks are actually down sharply from last year and the lowest since 2016/17. The stocks number from StatsCan is 1.85 mln tonnes, 23% less than a year ago. Even though the 2020 lentil crop was 20% larger than last year, the carry-in from the previous year was down 75%. In addition, exports through the end of December were reported to be up 47%. Based on StatsCan production numbers, green lentils are scarcer than reds.

This exceptionally strong Aug-Dec usage means supplies for the rest of the year are already tight and will limit export possibilities. Just like peas, demand rationing is taking place and will intensify over the rest of the year. That said, it appears India’s lentil imports will be slowing down anyway but other buyers will need to step up.

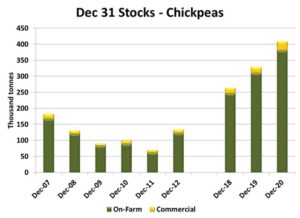

The one downer in the StatsCan estimates for pulses is chickpeas. While there is some skepticism that StatsCan has overstated chickpea production and supplies, uninspiring prices clearly demonstrate there’s no impending shortfall. As of December 31, StatsCan showed chickpea stocks just over 400,000 tonnes, 24% more than a year ago. Crops have been smaller the last couple of years but export demand just hasn’t been large enough to draw down supplies.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.