Pulse Market Insight #181 MAR 5 2021 | Producers | Pulse Market Insights

What’s Happening with Lentil Markets?

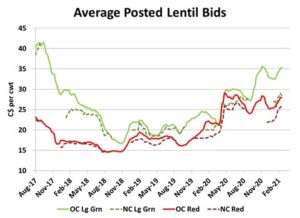

Perspective is everything when looking at grain markets and the timeframe for comparisons certainly colours a person’s price expectations. When it comes to lentils, the level of satisfaction with current prices largely depends on how far back you look.

For example, are red lentil prices in the 30 cent ballpark good or bad? Compared to the last 3-4 years, they’re really very positive but going further back, they look just so-so. It’s a similar situation for green lentils, with large greens pushing up against 40 cents. That’s more than double the lows of 2018/19 but still 50% below the highs experienced five years ago.

While these differing comparisons and expectations can be a little instructive when looking at possible upside, prices don’t just go back to those highs because someone wants them to. Basic supply and demand conditions still need to justify the move. For this article, we’ll look at red and green lentils separately.

As always, the red lentil market outlook depends heavily on the Canadian situation. According to StatsCan, the 2020 red lentil crop was 35% larger than a year ago but that production increase was largely offset by a sharp drop in the carryover from 2019/20. The net result was red lentil supplies were only slightly larger than the previous year. At the same time, red lentil exports have been running ahead at the strongest pace since 2016/17.

There are a few clouds on the horizon for red lentils though, which could limit the market. For one thing, the Australian crop was recently pegged at 634,000 tonnes, the second largest ever, and private analysts think it’s actually closer to a million tonnes. There have been logistical hurdles limiting Aussie exports in the short-term but those lentils are still poised to hit the market at some point. India’s rabi harvest is also underway and even though the government overestimated it at 1.35 mln tonnes, it will allow Indian buyers to focus on domestic product at the expense of imports for a time.

For green lentils, supplies have been even tighter. According to StatsCan, green lentil production in 2020 was actually 6% smaller than the previous year, with very little cushion in the 2019/20 carryover. Export demand has been very steady, as it tends to be for green lentils and supplies have been drawn down. One key difference for greens versus reds is that for green lentils, most buyers will keep purchasing even when prices rise. That’s one reason why the highs for green lentils tend to be higher than reds.

Canada and the US are the two main exporters of green lentils, which means fresh supplies won’t be hitting the market until the fall of 2021. Any buyers that don’t have sufficient coverage until then will need to keep raising their bids until closer to the next harvest.

Both classes of lentils have a fairly friendly outlook for 2021/22. Old-crop prices are firm and new-crop bids aren’t far behind. This tells us that even when the market does transition from old-crop to new-crop pricing at some point this summer, the shift will be relatively small.

In good part, that’s because there’s a general expectation that 2021 lentil acreage could actually decline and leave 2021/22 supplies even tighter yet. Even if seeded area is a bit larger, the increase won’t be enough to replenish supplies. And if there are any weather concerns on the horizon, the price outlook for 2021/22 gets even more positive.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.