Black Sea Conflict and Pulse Markets MAR 10 2022 | Producers | Pulse Market Insights

Chuck Penner, LeftField Commodity Research

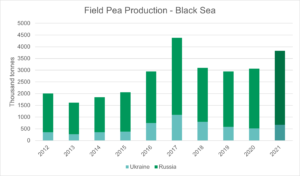

For pulses, the impact of the Russian invasion and resulting disruption varies, depending on the crop. In terms of volumes, peas are the largest pulse crop grown in the region, with more than 3.8 million tonnes produced. Russia is the largest source of peas but both Ukraine and Russia raised production in 2021 in response to stronger export demand. In the case of Russia, production also shifted to peas and other crops that aren’t affected by export taxes.

Roughly one-third of Russian pea production is normally exported while two-thirds of the smaller Ukrainian crop is typically exported. For both countries, Western Europe is a key destination for peas, largely as a feed source. Russia also exports sizable volumes into South Asia. Neither country has been able to export into China due to phytosanitary barriers, but Russia is negotiating with China to ease those restrictions.

In the short-term, the impact of closed Black Sea ports and restricted exports will have little impact on pea markets. Export shipments from both countries tend to be “frontloaded”, which leaves only small amounts left to be shipped in the final few months of 2021/22. The destinations for these Black Sea peas don’t really intersect with Canadian peas, so there’s even less of an impact expected.

The bigger impact would likely arise for the 2022/23 marketing year. If shipping restrictions remain in place, the lack of Black Sea peas would push more demand toward Canada from destinations that are normally serviced by Ukraine or Russia. And since Europe is a major buyer of Russian peas, there’s also the potential for sanctions on commodity trade.

The most pressing question is whether peas in the region will get planted this spring, a much bigger concern for Ukrainian farmers. Peas in Ukraine are planted early, typically in the next 2-3 weeks and right now, the conflict appears to be intensifying rather than calming down. And for Russian peas, even if they get planted, difficulties in shipping or financing of trades could restrict availability.

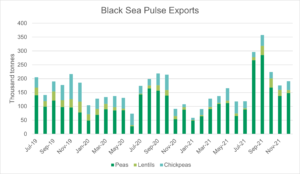

Lentil production in the region is much smaller, to the point that neither Russia or Ukraine issue official estimates of the lentil crop. Lentil production and exports had been larger a few years ago in response to strong Indian demand but volumes have decreased in the last two years. In 2020/21, just over 100,000 tonnes of lentils were exported from the region. So far in 2021/22, exports have picked up again with 114,000 tonnes during the first six months.

Russia is the largest lentil exporter in the region followed by Kazakhstan, with only small amounts coming from Ukraine. Disruptions to Black Sea ports would affect both Russian and Kazakh exports, particularly to Turkey. And trade sanctions are possible against Russia from some, but not all, regular customers.

Chickpeas are the third main pulse grown in the region, with most coming out of Russia. In 2020/21, 356,000 tonnes of chickpeas, mainly small calibres, were exported from the region and Russia accounted for 324,000 tonnes. Just like other pulse crops, difficulties financing and shipping the exports could reduce trade and sanctions from some countries could limit the trade.

So far, we haven’t noticed price reactions in Canadian or global pulse markets that can be directly attributed to events surrounding the Russian invasion. In general, prices for cash-traded crops don’t respond as quickly or to the same extremes as futures-traded crops. If there is a bullish influence, it will take longer to develop.

Exporters in Canada and other countries would have some ability in the short-term to respond to smaller pulse supplies available from the Black Sea region. But with tight old-crop supplies, not much can be done right now. For next year, the global market response would in large part, depend on the size of the 2022 crop, especially in Canada, with acreage and yields still highly uncertain. A big recovery in Canadian production would mute the reduced availability from the Black Sea while another small crop would cause an exaggerated reaction.

Chuck Penner operates LeftField Commodity Research out of Winnipeg, MB. He can be reached at info@leftfieldcr.com.