Pulse Market Insight #206 APR 1 2022 | Producers | Pulse Market Insights

No Supply Cushion Makes the Pulse Outlook Vulnerable

The punishing drought of 2021 was a clear reminder of how crops in western Canada are vulnerable to the lack of moisture. Conditions were already dry going into last spring and that was followed by low rainfall and extreme heat, causing yields of almost every crop to drop sharply. Even though pulses are generally better suited to dry conditions, they were no match for last year’s extremes.

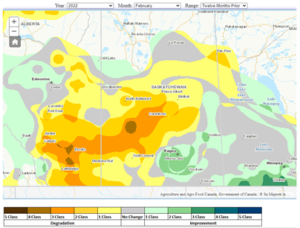

It’s no surprise to anyone that for large parts of the Canadian prairies (and the US northern plains), conditions early in 2022 are more concerning than a year ago. Compared to a year ago, the areas of the worst drought have moved west as snow was largely missing this winter in the southern half of Alberta and southwest Saskatchewan. This map shows the change in drought conditions in late February compared to a year ago.

That’s not to say there’s been no improvement; the northern and eastern prairies are looking at a better start due to heavy snowfall. In fact, seeding will be delayed in a few places due to excess moisture. For most areas though, subsoil moisture is lacking and in-season rain will be more critical than ever.

If conditions remain challenging and yields are reduced again in 2022, the market reaction could easily be just as extreme as in 2021/22. Of course, the size of the market response will depend on actual yields, but the lack of any real supply cushion would amplify another crop problem in 2022.

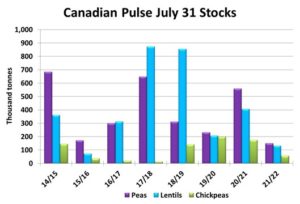

At the end of 2021/22, we expect Canadian pea inventories around 150,000 tonnes, less than a third of last year and the lowest since the mid-90s. Lentil ending stocks could drop to 135,000 tonnes, also a multiyear low. Chickpea stocks could be a bit more comfortable but still at the low end of the last few years. Those “cushions” won’t go very far if the 2022 crops are disappointing (again).

Of course, it’s too soon to start writing off a crop that hasn’t even been planted yet and we remain optimistic. If the rains show up and yields are decent, pulse markets that are on edge will start to “relax” and prices will soften from these historically high levels. Even so, the lack of carryover stocks into next year will keep inventories well below levels experienced in the years prior to the 2021 drought.

And if the 2022 crop is disappointing for a second straight year, markets could see fireworks again. Sadly though, those that need to see strong prices won’t likely get to cash in on them.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.