Pulse Market Insight #207 APR 29 2022 | Producers | Pulse Market Insights

StatsCan Acre Forecasts Don’t Point to Big Supplies

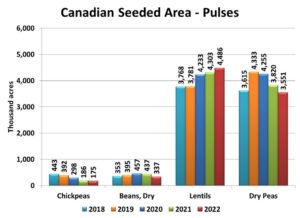

This week, StatsCan issued its seeding intentions estimates based on a March survey of 11,500 farmers. This isn’t the final word in seeded area and revisions are likely in StatsCan’s next acreage release on July 5. There’s also more detail needed such as acreage of the individual classes of pulses. Even so, it’s a good starting point for looking at 2022 crop potential.

StatsCan pegged seeded area of peas at 3.55 mln acres, 7% or 270,000 acres less than last year. This drop in pea acres is a little surprising. After all, both old-crop and new-crop prices of yellow peas are at levels never seen before. Plus, there was lots of discussion about how high nitrogen fertilizer prices could affect planting decisions.

Even with a drop in acres, the 2022 pea crop will almost certainly be bigger than last year’s disaster. That said, there’s huge variability in moisture conditions across western Canada, from bone dry to flooded, and that will make yields very hard to gauge. Using a conservative estimate that includes the low 2021 yield in the calculation would still mean a of 2022 crop of 3.2 mln tonnes, nearly a million tonnes more than last year. Even so, that’s still on the small side compared to the pre-drought average of 4.3 mln tonnes.

For lentils, the StatsCan survey showed a 4% increase of seeded area over last year, now at 4.49 mln acres. Despite strong lentil prices and high fertilizer costs, the strong competition from other crops limited the gains in lentil area. Restrictions on crop rotations also played a factor. Given the dryness that’s still a feature in parts of the prairies, a cautious yield estimate is likely in order. With that, the 2022 lentil crop could end up around 2.4 mln tonnes, 800,000 tonnes more than last year, which would be a 50% increase. That’s a whole lot of assumptions but if it plays out that way, supplies would be a little more comfortable but still wouldn’t be heavy.

The StatsCan survey showed a small decline in chickpea area at 175,000 acres, 6% less than last year. Once again, dryness in key production areas could limit yields in 2022, which could result in a crop a little over 100,000 tonnes. That would be a solid improvement over last year but not enough to rebuild chickpea supplies. There are questions about actual chickpea inventories in western Canada but it’s likely that even with a rebound in yields and a bigger crop, supplies in 2022/23 will be smaller.

The largest percentage decline among pulses was in dry beans, which StatsCan reported at 337,000 acres, 23% less than last year. In both western and eastern Canada, dry beans tend to compete with soybeans for acres and strong oilseed markets may have dampened growers’ enthusiasm for dry beans. Dry bean yields in 2021 were down, although the eastern Canadian crop kept yields from dropping too hard. A small recovery in this year’s yields would mean a crop around 320,000 tonnes, still 17% less than last year, and would result in lower supplies.

The chart of acreage also raises the question whether trends are developing for some pulse crops. For example, seeded area of peas has declined for three successive years and 2022 plantings would be the lowest since 2013/14. It may be a stretch to declare a meaningful trend based on three years of fewer acres, but it is a possibility.

On the flipside, lentil seeded area looks like it will be rising for the third straight year and 2022 area would be the most since the record set in 2016/17. Again, it’s probably too soon to claim a long-term trend but lentils seem to have gained the advantage over peas in western Canada.

The first few acres of pulses are being planted this week but in other areas, seeding will be delayed. Besides that wide planting window, there’s a huge range in moisture conditions across the prairies. These first acreage forecasts are only the first chapter in the 2022 crop story, with plenty of twists and turns in the plot before the final chapter is written.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.