Pulse Market Insight #208 MAY 13 2022 | Producers | Pulse Market Insights

Demand Outlook for Peas Just as Important as Supply

There’s a whole lot of attention given to the production and supply side of the pea market. After all, Canada is the largest exporter in the world, so supplies and availability here are critical for the price outlook. It’s natural to spend time thinking about crop possibilities and how they could affect the price outlook.

At this point in the year, there are lots of questions about the number of acres, especially with this year’s challenges of too much or too little moisture affecting seeding plans. Then there’s all the guesswork about possible yields. Experience over the last few years, when there’s been too little or too much moisture, has shown that yields really aren’t known until combines are rolling.

Regardless of the size of the 2022 pea crop, demand needs to show up to consume those supplies. And as we’ve learned in 2021/22 when supplies got very tight, some demand is much stronger than others. Certain customers were willing to pay the record prices while other buyers disappeared.

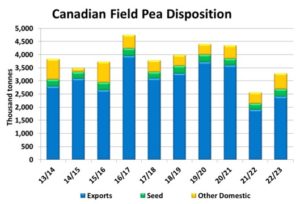

For example, pea demand in China, Canada’s largest buyer, consists of two main segments. The first is the fractionation industry, which separates peas into starch, protein and fibre. Of the 2.6 mln tonnes of Canadian peas exported to China the year before the drought, this sector accounted for just under half the total. The bigger portion of Chinese demand came from the feed industry, where peas compete with other ingredients.

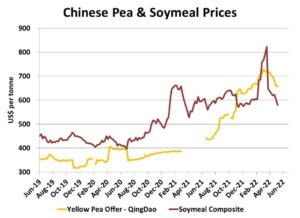

For the most part, China’s fractionation sector remained a solid buyer of Canadian peas in 2021/22, even as prices rose to record levels. The same can’t be said for the feed industry, which backed away from using peas and switched to other ingredients. The chart below shows prices that Chinese buyers would pay for yellow peas at port warehouses and a composite price for soymeal.

In the past, yellow peas were priced considerably cheaper than soymeal but that all changed in the fall of 2021, as Canadian peas became scarce. Aside from a Feb-Mar spike in soymeal prices, yellow peas in 2021/22 were too expensive relative to soymeal and feed users backed away, taking away roughly 1.5 mln tonnes of Chinese demand.

That loss of demand wasn’t much of a problem in 2021/22, since Canadian supplies were extremely small. Between China’s fractionation consumption and stronger demand from the US, there’s been no problem this year finding export buyers willing to pay up for limited inventories.

While the size of the 2022 pea crop is still far from certain, odds are there will be more Canadian peas available that will need to find a home. Domestic use will likely expand a bit more with facilities running at full capacity all year. Domestic feed use could also pick up, especially with sky-high feedgrain prices.

Things could get a little more difficult on the export front. It looks like more acres are being planted in the US, which would reduce its demand for Canadian peas. China is the big question mark. While the fractionation industry will still need 1.1-1.2 mln tonnes of peas, getting beyond that level of demand would mean encouraging feed use, and that would require lower prices. The same thing applies to rebuilding demand in other countries in Asia that were Canadian buyers prior to 2021/22.

We’ve also been watching one other added wrinkle in the outlook, and that’s the possibility of China dropping phytosanitary barriers for Russian pea imports. Those discussions have been going on for a while but now both countries have strong incentives to make it happen. Russia may have few other outlets for its peas while China seeks to diversify its sources, with Canada supplying 95% of its pea imports. If so, Canada will have more competition in its largest customer, adding more risk to the demand picture.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.