Pulse Market Insight #215 SEP 6 2022 | Producers | Pulse Market Insights

Early StatsCan Results in Question

There are always some doubts or criticism of crop estimates coming from StatsCan. That was the case when StatsCan used farmer surveys to estimate yields and is still the same now that they’ve changed methods.

In the last few years, StatsCan switched to using computer models to generate its first two yield and production estimates of the year. These models use satellite images of crop vegetation that are compared to long-term average conditions. Depending how much better or worse conditions are than usual, StatsCan determines a yield for the crop.

There are a couple of reasons to question the initial 2022 results. The first is timing. The satellite images used to generate the late August yield estimates were taken back in late July. We know crops like lentils and chickpeas grown in southern parts of Alberta and Saskatchewan were suffering then and only got worse in August. Because of that, there’s a good chance those yields were overestimated by StatsCan.

On the other hand, crops in the eastern prairies, especially the northeast, were planted late and are several weeks behind. Because of that, the satellite images from the end of July wouldn’t show a “normal” crop canopy for that time of year. Yields for crops grown there (such as peas) could be underestimated and final yields could end up larger.

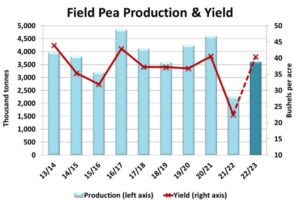

StatsCan pegged the 2022 pea yield at 40.4 bu/acre, a bushel and a half better than the pre-2021 average. For Alberta, the pea yield came in at 43.9 bu/acre, roughly a bushel lower than the estimate from the last provincial crop report. This rebound from last year’s 22.5 bu/acre would mean a 2022 crop of 3.6 mln tonnes, 60% larger than last year but still at the low end of crops prior to 2021.

This pea crop would mean 2022/23 supplies just under 4.0 mln tonnes, 1.1 mln tonnes more than last year but again, less than the years before the 2021 drought. Of course, Canadian supplies are only one part of the picture and there are lots of questions about the demand side.

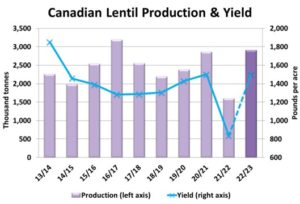

The StatsCan estimate for lentils was a bit more controversial. The yield was pegged at 1,504 pounds (25.1 bushels) per acre, the highest since 2013/14. Because lentils are mainly grown in the driest parts of the prairies this year, that seems like a long shot and early harvest results seem to bear that out. The StatsCan yield would mean a 2022 crop of 2.9 mln tonnes, the second largest on record. Our own guesstimate would be about 400-500,000 tonnes less than that.

Just like peas, the size of the Canadian lentil crop still needs to be balanced against the demand side of the equation. So far this fall, overseas buyers have been looking for routine amounts of lentils but aren’t exactly breaking down Canada’s doors. Even with a smaller crop estimate, the export interest will need to be strong.

The yield estimate for chickpeas was also “healthy” at 1,709 pounds (28.5 bushels) per acre, the highest in 10 years. Seeded area was down slightly this year but this would still mean a crop of 134,000 tonnes, 76% more than last year. Just like for lentils, our own guesstimate is considerably lower than StatsCan. Either way, Canadian chickpea supplies are down from the last few years with a friendly price outlook.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.