Pulse Market Insight #220 NOV 11 2022 | Producers | Pulse Market Insights

Early Export Performance Offering Clues?

It’s still very early in the 2022/23 market year and it’s risky to draw too many conclusions from exports over the first few months. Markets are always changing, often in unpredictable ways, and it’s important to hold predictions and forecasts lightly.

First, a couple of notes about sources of the export numbers. Canadian export data comes from StatsCan and the Canadian Grain Commission (CGC). The monthly export data from StatsCan covers all export movement and includes more detail (like destinations and subclasses of pulses). The downside is that it’s only released six weeks after the end of the month. For 2022/23, we only have August and September numbers so far.

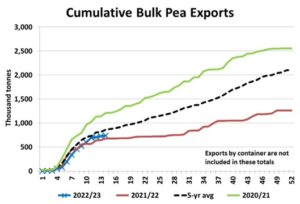

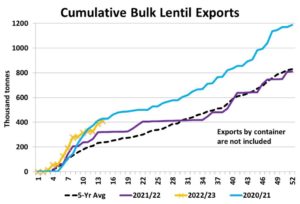

The CGC data is more current as it’s issued within a week of the exports. We already have data for the beginning of November. The problem is that it doesn’t include exports by container, not a big problem for some crops but misses a sizable portion of pulse crops, especially the smaller classes. The charts below are based on the CGC export data, mainly for yellow peas and red lentils that move in bulk vessel shipments. With that disclaimer and explanation, there are a few things we can glean from the first quarter of 2022/23.

Pea exports are always slow the first few weeks of the year and 2022/23 was no exception. Volumes then picked up, following the normal timing of a surge in fall exports. Through the first 14 weeks of 2022/23, 737,000 tonnes of (mainly yellow) peas have moved through bulk export channels. That’s better than last year at 677,000 tonnes but 2021/22 isn’t a great comparison. This year’s exports are trailing the 5-year average of 859,000 tonnes and are far lower than the 1.21 mln tonnes in the big export year of 2020/21.

While this slowish export pace is a bit of a concern, the 2022 crop is smaller than average, so a more modest export pace shouldn’t be a surprise or a big concern. Still, it doesn’t show there was huge pent-up demand for the 2022 harvest after the shortfall from 2021/22. Prices are off last year’s record levels but are still historically strong, high enough to discourage some demand. If current prices hold, export business will likely stay subdued. An increase in prices would mean even lower demand, which could leave larger 2022/23 ending stocks.

The situation for lentils is more positive. After the first few quiet weeks, exports turned strongly higher, running well ahead of last year and the average pace. Through the first 14 weeks of 2022/23, 413,000 tonnes of (mainly red) lentils have been exported through bulk channels, ahead of last year at 320,000 and even further above the 5-year average of 237,000 tonnes. So far, exports have been keeping up with the stronger pace of 2020/21 but that will be difficult to maintain, given that this year’s lentil supplies are 400,000 tonnes smaller than 2020/21.

This early performance is friendly for the lentil market, although exports often take a bit of a breather in the middle of the year. Developments in Australia, India and elsewhere could still change the flow for Canadian lentils but an average pace through the rest of the year will mean low 2022/23 ending stocks and firm prices.

Because most chickpeas and dry beans are exported by containers, the CGC data doesn’t capture that movement. The StatsCan exports show above-average exports of both pulses for August and September, which is a good (but very early) sign of demand down the road.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.