Pulse Market Insight #226 FEB 16 2023 | Producers | Pulse Market Insights

What Do Month-Old Stocks Numbers Tell Us?

Statistics, by their very nature, report on past events. Sometimes, that reporting is about very recent history and sometimes it’s dated. In the process of analysing grain markets, statistical reporting is needed to keep track of progress and finetune the outlooks. Of course, there are always questions about their accuracy or reliability. We’d also like them to be more current than they are but, in spite of their shortcomings, historical data is necessary.

Earlier this month, StatsCan issued its estimates of December 31 on-farm and commercial stocks, along with a set of supply and disposition tables as of the end of December 2022. These estimates are partly based on farmer surveys late in the calendar year, supplemented by grain handling data from the CGC. By now, they look a bit like ancient history but do provide some guidance.

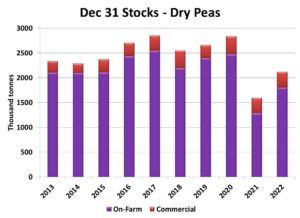

StatsCan estimated Dec 31 pea stocks at 2.12 mln tonnes, over 500,000 tonnes more than the previous year’s low, but the more important comparison is with the pre-drought years. Supplies during 2016 to 2020 averaged 2.72 mln tonnes and the chart shows how much lower this year’s pea stocks are than usual.

Of course, supplies are only one side of the equation. Export demand has been quieter too, and there’s clearly not as much concern about the low supplies. One interesting tidbit in the StatsCan pea S&D was that Aug-Dec domestic use was 345,000 tonnes, the most since 2013, which could reflect increased processing on the prairies.

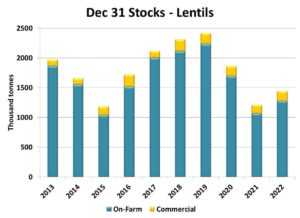

It’s a similar story for lentils. Stocks as of Dec 31 were 1.44 mln tonnes, up from a year ago but well below the pre-drought average of 2.08 mln tonnes. Based on price behaviour, it seems like green lentil supplies are a little tighter than reds. Even though Canadian lentil supplies are below average, the increased availability of Australian red lentils has offset the lower Canadian inventories.

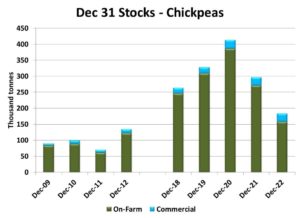

According to StatsCan, chickpeas are an exception, with this year’s December stocks actually much lower than even the drought year inventories. This year’s stocks are also well below the pre-drought years (StatsCan stopped reporting from 2013 to 2017). While global chickpea markets are already strong, these tight Canadian (and US) supplies are adding more firmness to North American prices.

The important consequence of these stocks estimates is how they will affect export business and prices through the remainder of 2022/23. In all three cases, export volumes for the rest of the year will be limited because supplies aren’t available, rather than a problem of weak demand. In general, this should keep prices supported, although situations outside of Canadian borders will also come into play. And finally, these low supplies also mean the final (July 31) ending stocks will be tight, leaving no real cushion for crop problems in 2023.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.