Pulse Market Insight #231 MAY 12 2023 | Producers | Pulse Market Insights

Stocks Numbers Don’t Leave Much Cushion

This week, StatsCan issued its estimates of March 31 crop stocks. The commercial inventories come from CGC tracking, which is reliable. For the on-farm stocks, StatsCan states, “Beginning in 2023, data for the on-farm stocks component of principal field crops, as of March 31, are modelled using survey estimates and administrative data.” We’re not quite sure what this modelling includes, but we have our doubts.

While the precision of StatsCan’s methods is in question, its numbers confirm ideas that supplies of pulse crops are tight, which means a couple of things. For one thing, it should limit the amount of downside pressure on prices during the seasonal declines that normally bottom out just before harvest. And for next year, it means there’s more pressure to produce a good-sized crop in 2023 to rebuild supplies.

For peas, StatsCan reported March 31 inventories at 1.47 mln tonnes. That’s 22% more than the drought year of 2021/22 but far less than the pre-drought 5-year average of 1.92 mln tonnes. This stocks estimate doesn’t break down supplies by type of peas but based on price behaviour, we would expect green pea inventories to be relatively tighter.

These low pea stocks haven’t been enough to keep yellow pea bids from slipping through the last few months, but that weakness is more related to quieter demand from China than supply levels in Canada. For green peas though, low stocks have been able to keep prices supported in recent months as demand is steadier and comes from a wider range of countries.

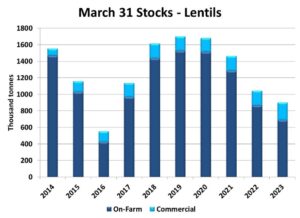

Lentil stocks were pegged at only 900,000 tonnes by StatsCan, even lower than 2021/22 and the smallest since 2015/16. We expect that in reality, lentil stocks aren’t likely that low but are still considered tight. While both red and green lentil inventories are quite low, higher prices for greens suggest those supplies are relatively scarcer than reds.

The low lentil supplies have provided solid prices through much of 2022/23, but some seasonal pressure is still possible ahead of the next harvest. For red lentils, Australia provides an alternative source for importing countries but for greens, there’s no other meaningful substitute for the low Canadian supplies. That’s another reason why green lentil prices have been performing better than reds.

StatsCan reported March 31 chickpea stocks at 112,000 tonnes, down nearly 60% from last year. While the real inventories are likely larger than that, supplies are tight and that’s been keeping prices well supported through 2022/23.

For all three of these pulse crops, the low inventories mean final (July 31) ending stocks will also be quite tight, especially for chickpeas and lentils. This reinforces the need for a bigger crop in 2023 just to keep supplies from shrinking. The problem is that for peas and lentils, StatsCan’s recent seeding intentions estimates point to fewer acres than 2022, with a modest increase for chickpeas. If acres don’t respond this spring, the yields become even more important to provide enough supplies for 2023/24.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.