Changes in 2025 Market Sentiment

Every marketing year is different, from both the supply and the demand sides of the equation. That said, ever since the 2021/22 drought year, pulse prices were mostly positive with supply and demand relatively well-balanced, although there were still regular ups and downs in the market. Pulse exports moved more-or-less freely and kept ending stocks in check.

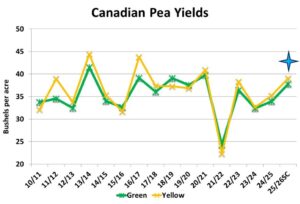

It also helped (for prices) that in the last few years, yields of Canadian pulses have been below long-term averages. In the three years after 2021/22, pea yields have averaged 35.0 bu/acre, almost four bushels less than the average before 2021/22. Likewise for lentils, yields averaged 1,200 lb/acre since 2021/22 versus 1,360 lb/acre prior to the drought year. These mediocre yields kept supplies limited and prices supported.

In 2025/26 though, pulse crops avoided the high temperatures of the last few years. Even though rainfall was variable, this year’s moderate temperatures during flowering and filling resulted in much stronger yields, and will likely end up well above StatsCan’s latest estimates. For example, StatsCan reported the Alberta pea yield at 40 bu/acre, while the Alberta Ag crop report showed a yield seven bushels higher, with a similar difference in Saskatchewan estimates. Lentil and chickpea estimates showed the same type of yield response.

The combination of increased acres of peas, lentils and chickpeas along with yields at multiyear highs have resulted in much larger Canadian pulse supplies needing to be sold. Word-of-mouth reports have also told us that forward contracting this year was slower than usual, partly due to concerns about short crops in the last few years. That’s understandable, but it also leaves even larger volumes that need to be sold in season.

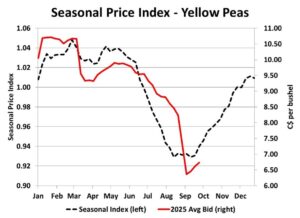

As this year’s pulse harvest progressed and the big yields became obvious to all, getting some of that crop sold took on more urgency. Prices were already declining through the summer but the increase in harvest selling triggered an even sharper downturn. It’s worth noting that this drop still fits the seasonal pattern for this time of year.

This year’s added urgency of selling off the combine exaggerated the move lower, but it also set the stage for a price rebound. It appears the heavy selling caused the price drop to be overdone. Once the rest of the crop was safely in the bin, bids already began to rebound, which also fits the seasonal pattern.

This bounce doesn’t mean there will be a sustained rally through the late fall and early winter. There’s no getting around that Canadian pulse supplies are very large. At the same time, the export market is facing challenges. Bigger crops are also reported in other exporters like Russia, Kazakhstan and Australia and competition will be more intense. Add to that, Chinese tariffs on imports are limiting demand for peas. There are also concerns that the Indian government could reinstate tariffs.

There is no doubt the pulse industry will face headwinds in 2025/26, which will limit how much prices can recover from the bottom. From a positive perspective though, the current low prices should also spur more demand from other sources. As the old saying goes, “the best cure for low prices is low prices.”

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.