Chinese Pea Demand is Positive but Not the Cure-All

No question, the news that China is dropping its 100% import tariff on Canadian peas is positive for the market. At a time of year when pea exports are normally slowing, renewed shipments to China will keep peas flowing into the system, which will keep prices supported.

Early in 2026, average western Canadian bids for both yellow and green peas are up roughly 60 cents per bushel. We emphasize the word “average”, because some buyers have raised their bids considerably more while others haven’t responded as much. People who were expecting bids to spike following the Chinese tariff announcement are probably underwhelmed with this response, but there are a few reasons for the relatively modest gains.

For one thing, China has been able to access plenty of peas from Russia, which had a record 5.2 mln tonne crop in 2025/26. Even so, Canadian peas are still preferred due to consistency of quality, which should provide a boost in trade. Chinese pea inventories are currently low, which should also add to a solid recovery in Canadian exports.

So far in its 2025/26 Jun-May marketing year, China has imported an average of 175,000 tonnes per month (with Russia as the main origin), which would mean a full-year import program of 2.1 mln tonnes. That said, the drop in pea prices closer to a Chinese corn/soymeal feed value suggests more peas will be imported for the feed channel, in addition to the food and fractionation industry, which could add another 300-400,000 tonnes of imports over the next few months. Under this scenario, Canadian peas would likely supply the food/fractionation demand while Russian peas are imported for the feed market.

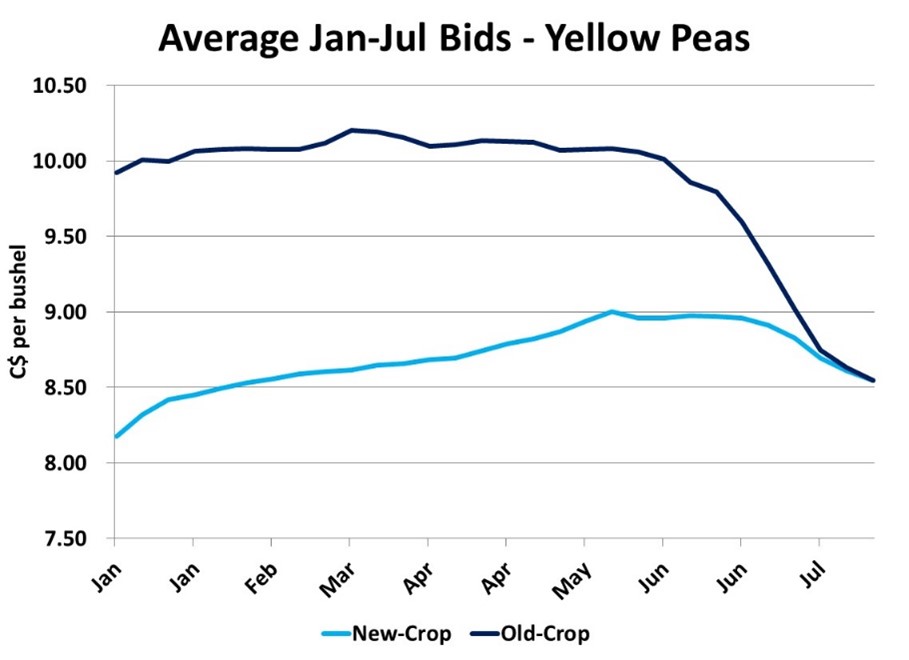

The tariffs aren’t scheduled to drop until March 1, but peas are being assembled ahead of time for export shipments. Even so, the stronger demand pull will be more noticeable in the coming weeks, which should allow bids to firm up a bit more. Keep in mind, stronger prices are typical at this time of year, with seasonal highs for both yellow and green peas in the March-May timeframe.

Unfortunately, Canadian pea exports to China will only be tariff-free for the last five months of the 2025/26 marketing year, not enough time to draw down supplies in a big way. While the increased exports will be helpful, they won’t be able to completely cure the heavy supply situation facing the pea market.

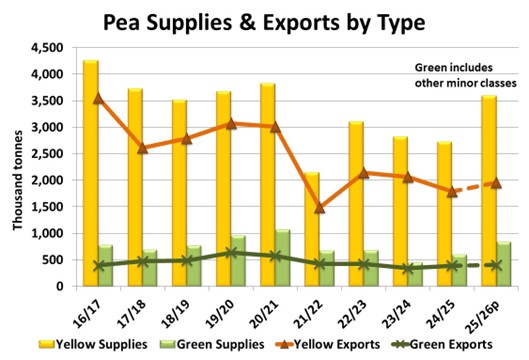

Our estimate of 2025/26 yellow pea supplies is 3.6 mln tonnes and even with increased shipments to China, full-year exports will still end up somewhere around 2.0 mln tonnes. That leaves more than enough yellow peas for feed and seed use, while still boosting ending stocks. It’s a similar picture for green (and minor) peas, with supplies around 850,000 tonnes compared to our export forecast of 400,000 tonnes. That will leave those ending stocks also at multiyear highs.

The bottom line is that while the resumption of pea exports to China is a good thing, it isn’t a quick fix, mainly because of this year’s big increase in Canadian supplies. But there is room for longer-term optimism. If Canadian farmers trim seeded acreage a bit and yields drop back to average, the 2026/27 crop will automatically be smaller. And if China and India don’t increase tariffs in 2026/27 (fingers crossed), a full year of demand from these two major buyers will certainly help draw down supplies and result in a more balanced market.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.