Pulse Market Insight #171 JUN 25 2018 | Producers | Pulse Market Insights

How Will Australian Pulse Crops Affect the Markets?

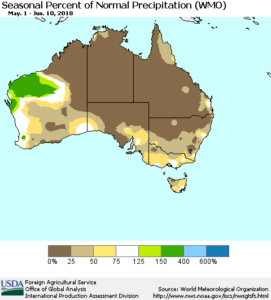

Canada isn’t the only place where pulse crops have been planted and farmers are nervously watching the sky. Conditions in many parts of Australia are just as dry as or even drier than the worst areas in western Canada. That’s especially the case in eastern Australia where the bulk of the pulse crop is grown. Parts of Queensland and New South Wales have seen virtually no rain so far in the growing season, and that’s been serious enough to discourage some acres from being planted at all.

Just as a quick geography lesson, the main states for growing chickpeas (90% desis) are Queensland and New South Wales. Pea and fababean production is centred further into the southeast along with a few acres in Western Australia. The lentil crop is grown mainly in Victoria and South Australia.

Last week, Australia’s Ag Ministry ABARES issued its first estimates of the 2018/19 crop. It should be noted that these projections are still highly tentative, not only for the yield component. Seeded area in some regions is also up in the air for reasons mentioned above. If rain doesn’t show up soon, these estimates could end up being quite optimistic.

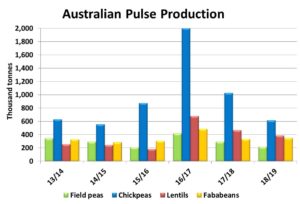

One of the overall themes in this ABARES report was that Australian farmers were cutting acreage for most pulse crops, in some cases significantly. The largest percentage drop was for chickpea acreage, which fell 53% from last year. Peas were down 17% and lentils were lower by 24%. Fababeans were the one exception, up 7% from last year.

Production estimates from ABARES were based on yields that are already below the 5-year average, which included the monster 2016 yields. The net result (although very preliminary) is 40% fewer chickpeas than last year, 26% less peas, a 17% drop in lentils and 5% more fababeans.

The big drop in the chickpea crop could support not only desi chickpea prices but could also help the pea market, if India starts importing more pulses again. The drop in Australian lentil production will keep global supplies from building up even more and that’s helpful, but it would take a solid recovery in Indian demand to really lift prices. And for fababeans, a small increase in production will have very limited market impact, especially since Australian feed demand is very high right now and will absorb the larger supplies with little difficulty.

The bottom line is that a smaller Australian pulse harvest is a good thing for the markets, to allow stockpiles to shrink. But the magnitude of that impact will still largely depend on India, especially its rabi pulse crop that won’t be harvested until early 2019.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.