Pulse Market Insight #136 FEB 20 2019 | Producers | Pulse Market Insights

Lentil Market Outlook

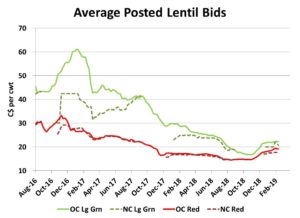

In contrast to previous years when there was a lot of action in lentil markets, 2018/19 has been pretty sleepy. Earlier this winter there was a brief flurry of “excitement” when lentil bids perked up a little, but the market has become quieter again in recent weeks.

The main reason for the late 2018 bump in bids was the rising concern about possible production shortfalls in India, caused by dry conditions and reduced acreage. The idea is that this would cause India to return as a larger lentil importer, either by reducing or dropping tariffs entirely. This concern triggered a number of buyers (not just India) to step up their purchases and that flurry of activity has certainly helped boost Canadian exports in January and February.

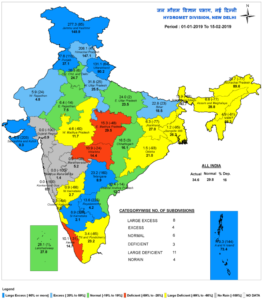

Since then however, there’s been some improvement in the situation in parts of India, including the north central region where lentil acreage is concentrated. Rainfall since the beginning of January (shown in the map) has caught up to normal in several parts of the country, but keep in mind it’s still the dry season, so the amounts aren’t huge. Seeded area of lentils ended up 3% lower than last year but 4% more than the 5-year average. These developments don’t mean a bumper crop is expected; but it also doesn’t look like the disaster that was feared earlier.

The impact of the modest improvement in the Indian outlook is that there’s less urgency for India to reopen its borders to lentil imports. Some imports are still expected, even with the 30% tariff, but the volumes won’t likely reach the totals that some had hoped for.

This has allowed Canadian lentil bids to flatten out again, but they haven’t really dropped off either. There is still some fresh export business being done to other destinations and that’s keeping the market supported. In fact, the pace of lentil exports actually increased in Jan-Feb, a time of year when volumes are normally lower. It also helps that farmers have set their targets a little higher and are less willing to sell than they were earlier this winter.

In general, we don’t expect to see a lot more upside in old-crop bids for either red or green lentils, although small 1-2 cent pops are likely, especially later in the marketing year when export sales need to be filled. But lentil supplies are simply too large to allow for a sustained rally.

The new-crop outlook depends on two main factors. The first is the planting intentions in western Canada. Most analysts are calling for a drop in acres, which would be helpful for prices. Our view is that seeded area will largely be unchanged, especially since old-crop bids moved up a few cents from last fall’s lows. New-crop bids are slightly below the spot market and may not attract a lot of sign-ups but still might be enough to keep farmers optimistic.

As always, prospects for Indian lentil imports will be the other main driver of the price outlook. In general, we expect India will buy more lentils next year than they did in 2018/19, but it won’t return to the boom year of 2016/17. If that’s the case, that should be enough to provide a little more support for lentil prices going into 2019/20.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.