Pulse Market Insight #145 JUL 5 2019 | Producers | Pulse Market Insights

What’s the Outlook for Lentils?

Over the past few months, there have been a few flickers of life in lentil prices but for the most part, bids have been stuck in a fairly narrow sideways channel. Because of that, it’s easy to think there’s not much happening. In reality though, things are percolating along, just below the surface.

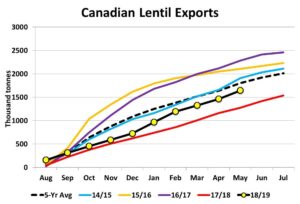

Canadian lentil exports were disappointing (but not surprising) during the first few months of 2018/19 when there’s normally a surge in fall shipping. That put the whole year’s export program behind the eight ball but volumes have improved, starting in January. Since then, monthly exports have been better than average and the year-to-date total is now catching up to the average pace. As of May, 2018/19 lentil exports are 1.64 mln tonnes, well ahead of last year’s 1.28 mln and getting close to the 5-year average of 1.80 mln.

Despite all the hubbub about tariffs, India has remained Canada’s largest buyer of red lentils so far this year but Bangladesh and the United Arab Emirates have also stepped up, taking sizable amounts. It also appears there’s more diversity among red lentil buyers in 2018/19, a positive development. Green lentil demand has been spread out among a large number of countries with Colombia in first place followed by India, Algeria and the UAE.

Even if this year’s exports don’t quite catch up to average levels, close to 2.0 mln tonnes will have been exported by the end of 2018/19. Because of that, this year’s ending stocks will end up close to 500,000 tonnes versus 873,000 in 2017/18. That’s still not considered tight, but sets the stage for some possible “excitement” in 2019/20.

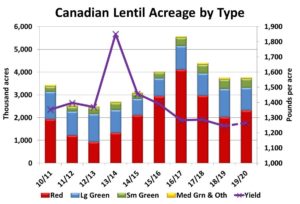

Last week, StatsCan released its seeded acreage survey results which were a little surprising (at least to us), showing seeded area at 3.78 mln acres, essentially unchanged from last year. Even though total acreage was unchanged, StatsCan indicated green lentil acreage would be down 16% while red lentil area would expand by 14% from last year. It’s worth noting that the USDA showed a 31% drop in 2019 lentil acres last week, with the large majority being medium greens.

Now that seeded area is more or less known, the focus shifts to yields. Lentil crops in southern Alberta and Saskatchewan started off in rough shape but the recent rains have allowed for some improvement. This week’s Sask Ag crop report showed that 50% of lentils were rated good or excellent compared to just 23% two weeks earlier. That’s still not fabulous, as conditions still lag last year at 61% and the 10-year average of 68% good/exc.

For now, we’re forecasting the 2019 yield at 1,265 lb/acre (21 bu/acre), 5% below the 5-year average. If that ends up close to the actual, the 2019 crop would be just marginally higher than in 2018. But remember that the carryover from 2018/19 is roughly 350,000 tonnes less than the year before. This means total supplies for 2019/20 will actually be down from the current year.

These prospects for reduced supplies next year are the factor that could provide some “excitement” in the market. Simply put, there won’t be enough lentils to match this year’s export program and that should give the market a little more lift. And if demand from places like India actually increases, the flickers of life could be fanned into a flame.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.