Pulse Market Insight #159 MAR 6 2020 | Producers | Pulse Market Insights

How Have Market Disruptions Affected Pulse Trade?

There has been no shortage of views about how trade difficulties in the last few months have affected crop markets. Opinions have varied from an irreparable disaster to only a brief hiccup. Pulse markets had already adjusted to the new reality of India’s import barriers, but the latest events of the Covid-19 virus and Canadian rail blockades have added new wrinkles to the outlook.

Have these disruptions caused serious long lasting problems to pulse crop movement? We’ve heard reports that some buyers have stopped taking in pulses, which certainly seems negative. But what do the numbers have to say about how widespread this problem is?

At first glance, there doesn’t seem to be a meaningful change in the movement of pulses in western Canada. When we look at the weekly CGC data, there doesn’t seem to be a large scale drop-off although there’s always some week-to-week variability. In general, farmers are still delivering and exports are still flowing.

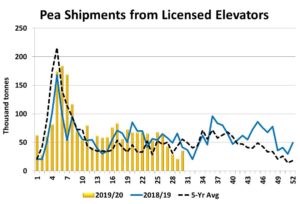

Bulk pea exports through the month of February (shipping weeks 27-30) have totalled 172,000 tonnes, actually ahead of the previous four week period. This keeps the 2019/20 export pace on track with the 5-year average and 380,000 tonnes ahead of last year at the same time.

Below the surface though, there are some glitches in the movement of peas. For most of the winter, farmer deliveries have been running well ahead of normal, signifying strong movement. In the past few weeks however, those volumes have declined and have now dropped below the average weekly amounts.

This is also mirrored in the shipments of peas out of country elevators. Compared to the earlier pace with consistently above-average movement, performance in the past four weeks has been substandard. This is causing a drawdown in pea inventories at terminal elevators while stocks at country elevators are building to the highest level since late September. This blockage in pea movement could turn around fairly quickly, if one or both of the underlying issues is resolved.

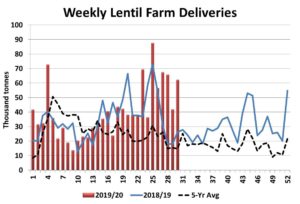

The situation for lentils is somewhat similar but the effect is less noticeable. In part, that’s because China isn’t a regular buyer of Canadian lentils and the Covid-19 issue there has had no real impact on demand. Any slowdowns in lentil movement are more directly connected to rail blockades in Canada.

Farmer deliveries of lentils have been well above average since early November and that remains the case, even in the past few weeks. The very slight “slowdown” could simply be normal variability and is hardly worth mentioning. Similar to peas, inventories of lentils at terminal elevators are running low while stocks at country elevators are rising. Export movement (not including containers) has been very strong with 149,000 tonnes in the past four weeks, more than double the previous four week period.

The outlook for renewed pulse movement is still clouded. Particularly for peas, that’s because it’s not easy to distinguish which of the two issues – Covid-19 or rail blockades – has been the larger impediment. The low inventories of peas and lentils at west coast terminals mean there will likely be a lull in export shipping in the next few weeks, but there are plenty of pulses sitting in country elevators that can move to export positions in short order. While it looks like full rail movement could resume soon in Canada, the coronavirus situation will likely drag on longer. And all of this comes at the same time as the spring road bans are about to hit, one more bump in the road.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.