Pulse Market Insight #160 MAR 20 2020 | Producers | Pulse Market Insights

How Are the Latest Market Gyrations Affecting Pulses?

The last Pulse Market Insight dealing with market disruptions was only a couple of weeks ago but it seems like there’s been another major shift in the markets. The Covid-19 issue has become a lot more real for all sorts of people, including agribusinesses. Grain handling companies are sending out notices about new protocols for taking precautions while receiving or shipping crops. One of the big questions is how this will affect the markets for pulses.

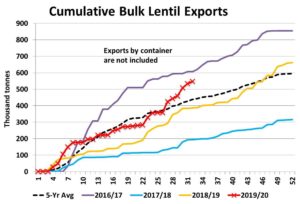

It’s clear there will be some delays and glitches as extra care is taken in handling crops but in terms of overall movement, there hasn’t been a noticeable drop-off, at least for bulk shipping. As we showed in the previous Pulse Market Insight, farmer deliveries of peas and lentils into country elevators and shipments from the country to terminal elevators have actually been improving.

In the past two weeks, farmers delivered over 150,000 tonnes of peas and 100,000 tonnes of lentils to licensed elevators. Country elevators have shipped out 91,000 tonnes of peas and 132,000 tonnes of lentils over the past two weeks. That’s a solid improvement from previous weeks and tells us that portion of the export pipeline is still running well.

While bulk shipping is still humming along, container movement is experiencing interruptions. The original Covid-19 issues arose in China, the central cog in container shipping, and quarantines there disrupted the flow of empty containers back into Canada, causing a shortage that will take time to resolve.

Even where disruptions occur, our view is that the problems will not cause permanent demand destruction. In fact, there are some who believe that demand from importing countries could actually rise in the short to medium-term before leveling off again. As the saying goes, “people still need to eat”, and buyers in these countries could increase their purchases out of concern about supply availability.

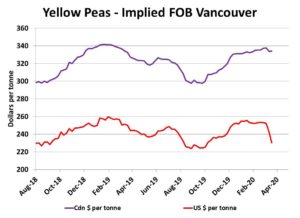

So far, bids for peas and lentils in western Canada have hardly budged at all, another sign of steady demand. Of course, that’s measured in Canadian dollars, which can disguise other dynamics. The Covid-19 crisis, along with the sharp drop in crude oil prices has caused the loonie to drop hard, falling below 70 cents US. The impact of this 5½ cent drop in the Canadian dollar can be seen in the chart below.

Our estimated Vancouver FOB pea price looks quite stable in Canadian dollars but, measured in US dollars (the currency used in international trade), has dropped by US$22 per tonne since early March. This weakness in yellow pea prices can actually be viewed positively, as overseas buyers now have an opportunity to pick up a “bargain”. Lentils and other pulses are also feeling that same influence. If so, it will encourage even more short-term buying.

Now that rail movement has also picked up in western Canada, these developments could spur extra buying in western Canada and could provide more lift for Canadian bids. That’s not to say everything is hunky-dory, but some of the clouds on the horizon may have a silver lining.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.