Pulse Market Insight #180 FEB 19 2021 | Producers | Pulse Market Insights

2021 Acreage Musings

Going into the spring of 2021, there seems to be much more optimism and positive sentiment in the crop sector than most other industries. True, there’s still the pandemic thing to deal with, but the outlook is very upbeat. It’s not often you hear comments like, “Yes, that’s a great price and I can make a good profit but I think I’ll wait a bit longer before pulling the trigger.” This is one of those years.

My purpose in this article isn’t to convince anyone that they should be selling now. I’m also not going to try and forecast how high prices will go next year. In my opinion, that’s always been more luck than brains (either that or I’m just not good enough at predicting the future). My personality leans toward caution so I would be more concerned about locking in profits than picking market highs. But I also realize other people think differently. Plus, it’s not my money at stake.

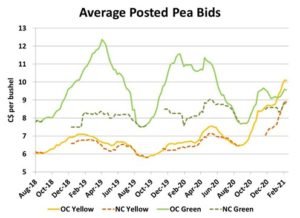

In any case, prices for most pulse crops (other than chickpeas) are looking very favourable, including both old-crop and new-crop bids. The chart below shows average bids across western Canada for green and yellow peas. Keep in mind these are average bids, including very aggressive buyers and the not-so-active buyers. Top-end bids are definitely higher, especially in the western prairies.

New-crop pea bids are reflecting the concern among buyers about locking in supplies for next year. Yellow pea bids for the fall of 2021 are the highest they’ve been in years and even green peas are close to the high-end. This tells us that buyers are still trying to encourage planting of more peas.

Normally, these kinds of prices would attract a whole lot more pea acres but the difference this year is that prices are high for almost all crops, making the competition for acres very intense. Disease concerns for peas and other pulses have also become more widespread, which will limit the increase.

As a result, we’re forecasting seeded area at 4.4 mln acres, 3% more than last year, made up of a decline in green pea acres and a larger increase for yellows. Even with this record acreage, average yields would mean supplies wouldn’t be any larger next year. The level of Chinese buying in 2021/22 is a key unknown, but steady demand would mean tight ending stocks again.

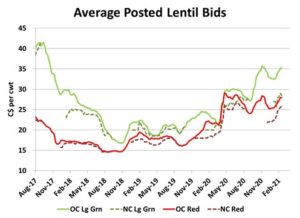

Lentil bids are also looking positive but aren’t quite at the same height as peas. Both red and large green bids have been moving higher lately but still haven’t risen past the earlier highs. And as with the chart for peas, we know that individual buyers are paying more than the averages shown below.

Given these prices, lentil returns are very positive but may not be at the same levels as some other crops, especially with additional production risks. As a result, we’re actually forecasting a small 2% decline in 2021 lentil seeded area but that would be made up of a larger decline for reds while large green acreage could actually rise slightly.

If lentil yields drop back to the 5-year average in 2021, the reduced acreage would be compounded by lower productivity and the size of the crop would shrink considerably. This would mean tighter supplies next year and even lower ending stocks.

While these are our educated guesses about seeded area, we know that farmers make their decisions based on a whole lot of factors. Price is a big one but certainly not the only one. Given the uncertainty about predicting the future, some like to stick with their regular rotations to manage agronomic issues. Others are more contrarian in their approach and bet on crops that others are avoiding. In the end, it looks like 2021/22 could be a year where everyone does well.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.