Pulse Market Insight #193 SEP 17 2021 | Producers | Pulse Market Insights

Yield and Supply Ideas Taking Shape

There will always be disagreement about the size of the 2021 crop, especially since this has been such an extreme year. But now, we’re hearing from a few different sources and the range of estimates is starting to narrow. These includes a couple of model or satellite based estimates from StatsCan as well as provincial crop reports. For better or worse though, the final authority will still be the survey-based results from StatsCan, which won’t show up until early December.

In the meantime, we’ll try to distill some of these various reports into a rough idea of the size of 2021 pulse crops. Then, we’ll add in StatsCan’s estimate of the carryover from 2020/21 based on surveys of farmers’ and industry inventories at July 31, to give us a supply picture for 2021/22.

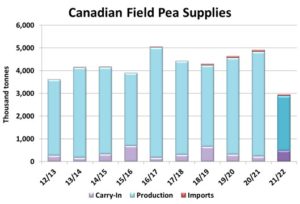

For peas, StatsCan’s first yield estimate in late August was 25.9 bu/acre, which was then lowered to 24.9 bu/acre a couple of weeks later. This is slightly below the latest Alberta Ag yield number at 25.6 bu/acre and a bit above Sask Ag at 21 bu/acre. So it seems like a reasonable yield estimate with the pea harvest essentially complete.

One thing that StatsCan didn’t account for was the additional unharvested area as some of the worst fields were written off. Once we’ve made an adjustment for that, we estimate the 2021 Canadian pea crop a bit over 2.4 mln tonnes, just over half of last year’s production. When this is added to the StatsCan old-crop carryover of 478,000 tonnes, total supplies for 2021/22 would be just a shade under 3.0 mln tonnes. That’s 1.9 mln tonnes (40%) smaller than last year’s supplies.

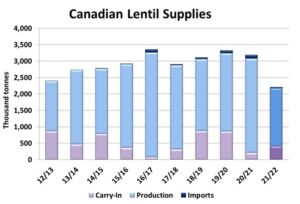

The first lentil yield estimate from StatsCan came in at 1,030 lb/acre, which was then dropped to 938 pounds in its latest estimate. This is still well above the much smaller yield estimate of 817 lb/acre from Sask Ag and leaves the range of outcomes a little more uncertain. For now, if we apply the StatsCan yield and adjust for lower harvested area, the 2021 lentil crop would come out at 1.77 mln tonnes, 1.1 mln tonnes (38%) smaller than last year.

StatsCan did show a larger old-crop lentil carryover just over 400,000 tonnes, which means total supplies for 2021/22 would come in at 2.2 mln tonnes, which is still 31% less than last year.

For chickpeas, StatsCan reported a record low yield of 790 lb/acre, which is in line with the Sask Ag estimate. With an adjustment for more abandonment, the 2021 crop would be 60-65,000 tonnes, 71% smaller than last year. Unfortunately, there’s a lot of uncertainty about the old-crop chickpea carryover, as most traders expect much less than the estimate shown by StatsCan. We’re expecting at least a 200,000 tonne drop in 2021/22 chickpea supplies but, regardless of the exact number, supplies will much lower than last year.

The one thing that all these pulse markets have in common is that supplies are far below what was used in domestic and export markets last year. This means that (mostly) export programs will be cut back sharply, causing buyers to bid more aggressively to get sufficient coverage. It’s also forcing importers to look elsewhere for pulse supplies, but large enough quantities simply aren’t available. No surprise to anyone, prices have been reflecting this situation, with strong gains starting already in late summer.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.