Pulse Market Insight #195 OCT 15 2021 | Producers | Pulse Market Insights

How is Lentil Demand Looking in 2021/22?

In our last report, we looked at how the pea market is responding to the sharp drop in Canadian supplies. This time, we’ll look at lentil demand and how it’s adapting to the new and challenging environment for 2021/22.

It’s always tempting to think in terms of lentils as one large generic market but that’s certainly not the case. There’s sometimes a bit of overlap among the various sizes of green lentils, especially when supplies are tight, but red lentils have an entirely different type of demand. A number of countries buy both green and red lentils but that doesn’t mean they’re interchangeable by any means.

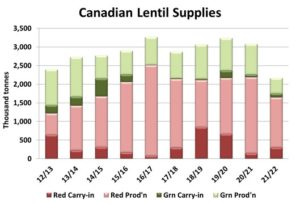

No surprise to anyone, supplies of both green and red lentils are down sharply in 2021/22. Earlier this fall, StatsCan showed an increase in the old-crop carryover but that was easily overwhelmed by the 38% drop in the 2021 crop. Based on some acreage data and some other calculations, the cut to supplies was more severe for greens, down 43% from last year and the lowest in almost 20 years. Meanwhile, red lentil supplies look like they’re down “only” 25% from last year but that’s still the lowest since 2013/14.

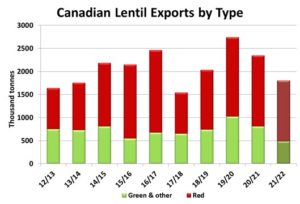

So the big question is how importers will respond to this historically low supply situation. Prices have already spiked to multiyear highs but haven’t quite reached the all-time records (yet). Obviously, overseas buyers have been scrambling to get their needs covered but it’s not clear yet if they’ve bought enough yet to tide them over until fresh supplies are available. There’s no question though, Canadian lentil exports will be severely curtailed by limited supplies.

For red lentils, the big buyers are typically India and Turkey, with the UAE and Bangladesh also sizable importers. In terms of the supply calendar, the next available red lentil crop will be coming from Australia in the next month or two and those prospects are looking quite positive. Although the Aussie crop isn’t nearly as large as Canada’s, this will help fill the supply gap. Then, the Indian crop arrives in Feb/Mar of 2022, which would satisfy some of its own needs, although not from other countries. The Turkish harvest then shows up in Jun/Jul, followed by the next Canadian harvest. At this stage it’s far too early to speculate on the size of the Indian or Turkish crops, but there are prospects of some temporary supply relief for red lentils.

That same situation doesn’t really apply to green lentils. The two major exporters are Canada and the US, both with crop disasters in 2021. This means there aren’t any meaningful supplies showing up until the 2022 harvest in North America.

Green lentil demand is scattered across a larger number of countries. India is still the largest buyer but there are many other countries buying good volumes of green lentils. We’ve also seen over the years that green lentil demand tends to be more price inelastic than for reds, with more buyers willing to pay up to get the supplies they need. This is one reason why the historic highs for green lentil bids have been higher than for reds.

The bottom line is that supplies of both red and green lentils will be very tight throughout 2021/22 but more so for greens. And green lentil buyers are more prepared to chase the market higher. Beyond this year, western Canadian lentil acreage should expand in 2022, but nearly all crops are looking positive for next year, so the effort to rebuild supplies could take another year or so.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.