Pulse Market Insight #196 OCT 29 2021 | Producers | Pulse Market Insights

Acreage Outlook for 2022 Closely Watched

It’s only one quarter of the way into 2021/22 and already, there’s a lot of attention on next year’s crop. The historic 2021 drought has triggered big market reactions and has also changed how farmers view decision-making. Factors that weren’t all that important before have become front and centre. And with razor-thin supplies of nearly every crop, the stakes for both sellers and buyers are very high.

Decisions about which crops to plant have never been simple. As a market analyst, my first thought is how prices affect decisions but over the years, I’ve learned not to weigh that factor too heavily. This year, it’s even harder than usual to ignore the influence of prices when nearly every crop is either at a record level or a multiyear high. But factors like crop rotations, herbicide issues, diversification, contrarian thinking and others still come into play.

This year, there are a few added variables that will shape decisions. The drought that devastated yields in most parts of the prairies is still lingering in many areas. After the 2021 experience, farmers will be extra cautious about choices, especially for crops that performed poorly this summer. The added risk of putting in crops with higher input costs could also sway acreage.

Rising input costs and concerns about availability, particularly fertilizer, are also expected to influence decisions. This is one area where pulse crop acreage could get a boost, although that’s still weighed against other factors. Seed supplies are another important consideration for 2022.

While it’s easy to focus on the extremely high old-crop prices, new-crop bids are just starting to emerge. Compared to prices for nearby delivery, bids for the 2022 crop might seem weak but historically, the levels are very attractive. Of course, this year, farmers will be paying much more attention to contract details; Act of God clauses will be a must.

All that said, we’ve stuck out our neck and issued some very early 2022 acreage ideas. Do we think this is exactly how things will play out? Absolutely not, but this seems to be the way things are leaning right now. And yes, things will certainly change over the winter.

There are some great (in some cases, record) old-crop pulse prices out there but that may not be enough to stand out from the crowd. New-crop bids are just starting to show up now and are historically good but nowhere near spot prices.

Where pulse crops will have an advantage in 2022 is the need for little, if any, high-priced nitrogen fertilizer. That alone could be enough to tip the scales in favour of pulses. In general, pulses perform better under dry conditions than many other crops, and this will likely be an extra supportive factor in many parts of western Canada next year.

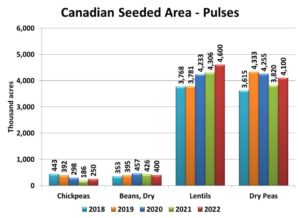

Both of the major pulses – peas and lentils – could see a 5-10% acreage increase next year. At 4.1 mln acres, pea area wouldn’t be large by any means, but simply a recovery from last year’s lower level. With average yields, that’s still not enough to set the world on fire, although the demand side of the pea S&D has shifted considerably in the past year because of small crops and big prices. Lentil plantings of 4.6 mln acres would be the largest in several years but would still be nearly a million acres less than the record of 2016. Again, it’s more about replenishing supplies.

Not to be lost in the shuffle, both chickpea and dry bean prices have been rallying strongly in 2021 and should also attract more attention (along with every other crop). These acres are harder to nail down, but we’re forecasting a sizable bounce back for 2022 chickpea acres but still well below previous years. Dry bean acreage has been historically large the last couple of years and there’s a good chance seeded area will slip a bit more, despite the positive prices.

As always, we don’t expect everyone to agree and are always open to other opinions.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.