Pulse Market Insight #210 JUN 10 2022 | Producers | Pulse Market Insights

Market Signals from Australia

This week, estimates of 2022/23 Australian crop production were issued by ABARES, the country’s Ag Ministry. At this early point in Australia’s winter crop cycle, the estimates of seeded area are more helpful than the actual yield and production forecasts, as a lot can happen in the months ahead.

A couple of things to note before digging into the numbers. Yields for all winter crops in Australia, including pulses, have been well above average for the past two years, and there are questions about whether a three-peat is possible. In its projections for 2022/23, ABARES is showing yields lower than the last two years but still above the 5-year average.

There is some support for the idea of above-average yields as moisture conditions going into this next growing season are generally favourable in most parts of the country. Of course, there are regions that are too dry and others too wet. Overall, there’s a fair amount of optimism again.

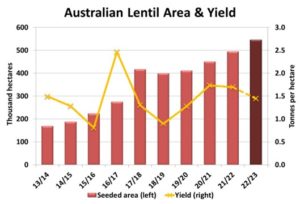

For lentils (mostly reds), ABARES is showing seeded area at 546,000 hectares (1.35 mln acres), up 10% from last year and the most on record. This continues the recent trend of increasing lentil production in southeastern states. The more modest yield projection for 2022/23 would mean a crop of 788,000 tonnes, down from last year’s record but still historically high and large enough for strong competition with Canadian lentils.

Seeded area of peas for 2022/23 is estimated to be up 7% at 205,000 hectares (506,000 acres) but pea plantings in Australia have generally been declining for a few years. A drop from last year’s exceptional yield is reported by ABARES, with production forecast to come in at 238,000 tonnes, 9% less than a year ago. The Aussie pea crop is relatively small compared to Canada, but Australian peas have been finding their way into the Chinese market in recent months.

Chickpea plantings are projected to decline considerably, partly due to excess moisture in Queensland and parts of New South Wales. Seeded area is reported at 443,000 hectares (1.09 mln acres), 28% less than last year. A more cautious yield estimate from ABARES puts the 2022/23 crop just over 600,000 tonnes, 43% below last year’s crop. Since most of these chickpeas are desis, there’s limited competition with Canadian kabuli chickpeas.

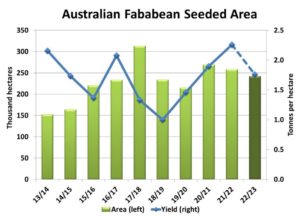

Australia dominates the global fababean market and after two large crops in a row, ABARES is showing a 6% decline in seeded area at 242,000 hectares (600,000 acres). With a lower yield than last year, the 2022/23 fababean crop is forecast at 425,000 tonnes, 27% less than last year. Even so, that’s enough to keep export demand well supplied and will mean stiff competition for Canadian exports.

The seeded area estimates will likely see some adjustments in the coming months but won’t likely shift too much. On the other hand, yields are still very tentative and the production totals could see large moves. If the positive start continues, yield numbers will tend to move higher, resulting in large pulse crops again in 2022/23.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.