Pulse Market Insight #222 DEC 23 2022 | Producers | Pulse Market Insights

Factors to Watch in 2023

This is the time of year when the news is full of reviews of the last year or predictions for the year ahead. Recently, I read a quote that said something to the effect that hindsight marketing is 20/20 but useless. On the flipside, predicting the future is a problem, because it’s the future. In my view, the best we can realistically do is reconnaissance, scouting out events on the horizon for their possible impact on markets.

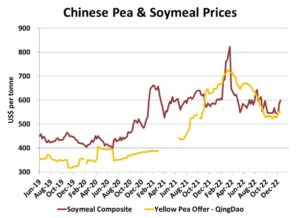

For peas, especially yellows, the biggest factor affecting markets is the level of demand from China. So far in 2022/23, exports have been okay but not great. Most of that mediocre performance is because China is only buying peas for fractionation, not feed. The way to improve exports would be for Canadian peas to be more attractive to Chinese feeders. The problem is Canadian farmers will likely stop selling if prices drop. The better option is for prices of soymeal and other feeds to rise, with the outlook largely depending on Argentine and Brazilian crops. Soybean and corn crops in the south are still on a knife’s edge and have the potential to move soymeal and, by extension, pea markets.

On a related note, demand from China, the dominant buyer of Canadian peas, is influenced by the condition of its economy. It looks like there could be plenty of bumps on the road to economic recovery but is an important factor to watch.

Indian farmers are currently planting their rabi crops, including peas. Seeded acreage of peas is down slightly but area of desi chickpeas, a close substitute, looks close to average. Moisture conditions are still favourable but January is the critical month for the crop outlook. That said, it would take a large crop problem for India to open the door to pea imports.

New-crop bids aren’t yet widely available for yellow or green peas in western Canada. Buyers are caught between higher price expectations from farmers and importers’ reluctance to commit to new-crop cargoes. If bids don’t improve, it wouldn’t be surprising if 2023 acreage declines. Ultimately, that would be friendly for the markets, but patience could be needed.

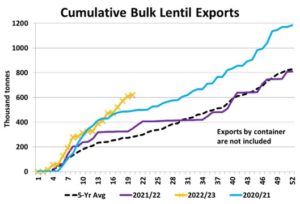

Lentil bids have been running mostly sideways since the initial recovery from the harvest lows. Even after the normal surge in fall exports, volumes have continued to run well ahead of average. That hasn’t had a noticeable impact on bids yet but if this continues, lentil supplies will be drawn down. At some point, Canadian farmers could say they’ve sold enough and start to close their bins.

The Australian lentil crop is mentioned as the main reason red lentil prices haven’t been able to turn higher. Harvest there is moving ahead with some surprisingly good results despite heavy rains. That said, there still could be some surprises with the size or quality of that crop. Stay tuned.

India is always seen as the big market for Canadian lentils. Currently, Indian farmers are planting the rabi lentil crop and seeded area is larger than normal. Moisture conditions are quite favourable and will need watching, especially through January, with the harvest in February or March.

Supplies of chickpeas are low in other countries and are being drawn down in Canada too. So far, chickpeas have been one of the firmest markets. Indian and Mexican harvests won’t be showing up for a while and that still leaves a few months until fresh supplies arrive. Further out, the strong chickpea market could encourage Canadian farmers to boost acreage and, depending on yields, could keep a lid on the market.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.