Pulse Market Insight #184 APR 30 2021 | Producers | Pulse Market Insights

Acreage Estimates Provide Friendly Market Signals

In a normal year, the current prices for most pulses would have been enough to buy double-digit increases in seeded area. New-crop bids of $9-10 for yellow peas and 30 cents (plus) for lentils would have attracted a whole lot of acres. Of course, 2020/21 has been unusual in a whole lot of ways, particularly in the intense competition for acres in western Canada.

Instead, this week’s StatsCan seeding intentions estimates for pulses are pretty much “meh”. With high (in some cases, record) prices for almost every crop out there, there was no need for farmers to push crop rotations one way or another. For pulses, the steady to lower acreage is actually a positive thing. It’s not only helpful from an agronomic and disease standpoint, but prices will also benefit if crop supplies don’t expand much or even shrink.

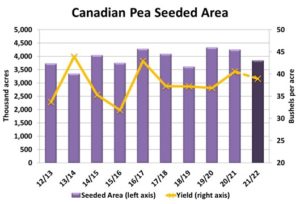

Earlier, we thought the historically strong yellow pea bids would at least be able to keep 2021 acreage steady, but StatsCan reported farmers responded with a 10% decline in seeded area from last year. The 3.84 mln acres reported by StatsCan was also below the average trade guess of 4.1 mln acres. We expect the acreage drop will be much more severe for green peas than yellows.

It’s far too early to make any realistic yield estimates so at this time of year, we use the 5-year average in our calculations. This would mean a 2021 pea crop just under 4.0 mln tonnes, 600,000 tonnes less than last year. That’s going to force a reduction in next year’s export program, especially since more peas will be processed in Canadian plant protein facilities. Chinese demand is always a bit of a mystery but suffice to say, supplies in 2021/22 won’t be large enough to meet demand and that’s positive for prices.

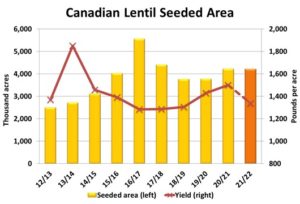

Lentil plantings fared a little better than peas and were at least able to stay steady from last year. The 4.22 mln acres reported by StatsCan were in line with our ideas and slightly higher than the average trade guess but once again, strong prices didn’t buy any extra acres.

Until more is known about how the crop is progressing, we use the 5-year average yield, which would put the 2021 lentil crop at 2.52 mln tonnes, 350,000 tonnes less than last year. Just like peas, that has the potential to cause 2021/22 lentil supplies to tighten up and will restrict next year’s export program. As a rule, lower supplies support prices, especially if export demand remains solid as we expect.

It wasn’t surprising to see a large decline in chickpea plantings, partly due to disease concerns but also because of prices that haven’t (until recently) show much life. StatsCan pegged seeded area at 212,000 acres, 29% less than last year. This should be enough to allow supplies to start shrinking in 2021/22, and that’s happening at the same time as the global market is starting to warm up. The combination of these two elements should be helpful for the price outlook.

As mentioned, we’re using average yields at this early stage in the season, but we also recognize conditions are very dry in many pulse growing areas of the prairies. If the moisture situation doesn’t improve, supplies will tighten even further and prices will respond accordingly.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.